UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registranto

Check the appropriate box:

|

| |

ox | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

xo

| Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

JPMorgan Chase & Co.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

o

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

JPMorgan Chase & Co.

270 Park Avenue

New York, New York 10017-2070

April 5, 20174, 2018

Dear fellow shareholders:

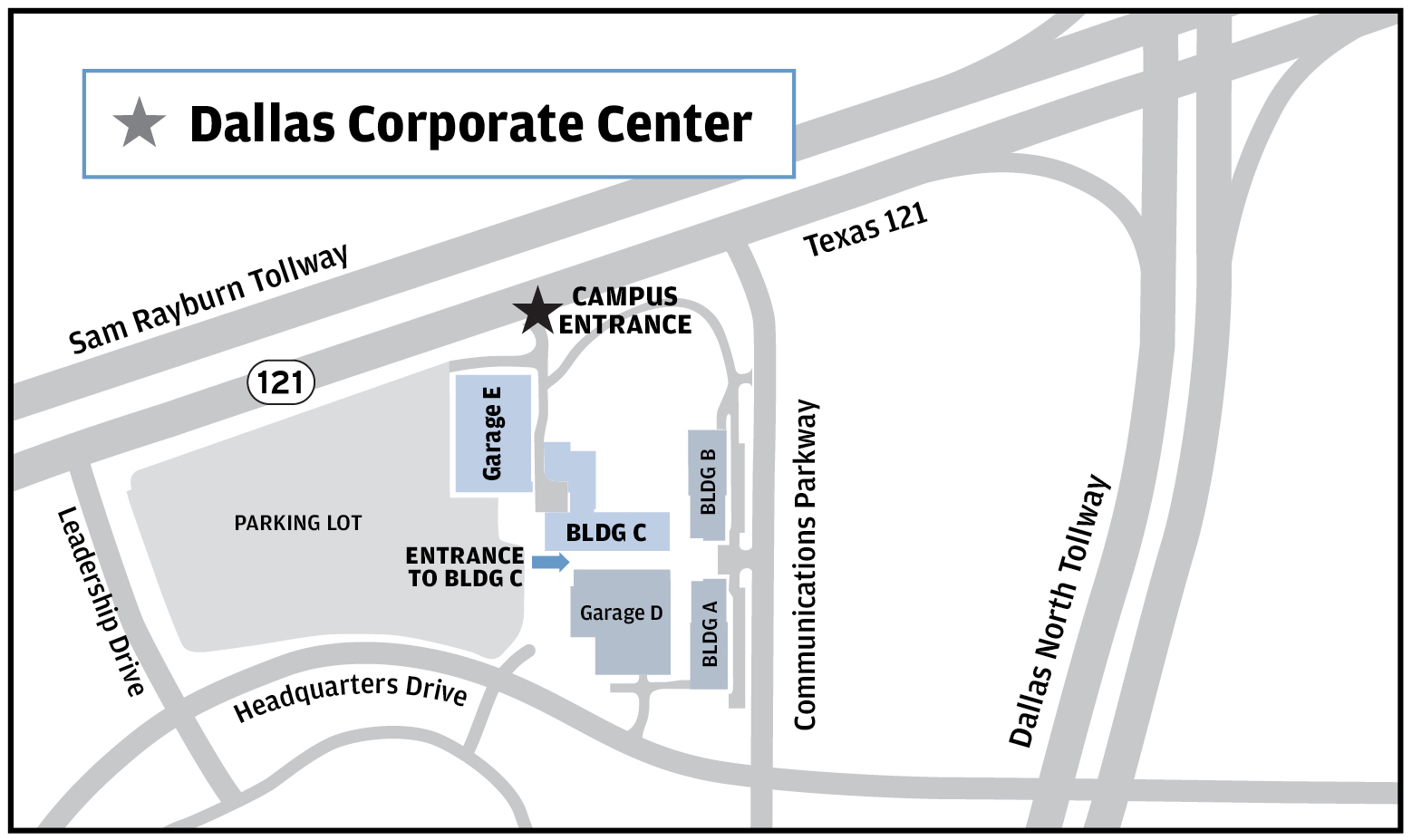

We are pleased to invite you to attend the annual meeting of shareholders to be held on May 16, 201715, 2018 at 10:00 a.m., local time, at the JPMorgan Chase Delaware TechnologyDallas Corporate Center Wilmington, Delaware. As we have done in Plano, Texas. This forum provides shareholders with the past, in additionopportunity to consideringdiscuss topics of importance to the Firm’s business and affairs, to consider matters described in the proxy statement, we will provideand to receive an update on the Firm’s activities and performance.

We hope that you will attend the meeting in person. We encourage you to designate the persons named as proxies named on the proxy card to vote your shares even if you are planning to come. This will ensure that your common stock is represented at the meeting.

This proxy statement explains more about the matters to be voted on at the annual meeting and about proxy voting. Please read it carefully. We look forward to your participation.

Sincerely,

James Dimon

Chairman and Chief Executive Officer

A LETTER FROM JAMIE DIMON, OUR CHAIRMAN, AND

LEE R. RAYMOND, OUR LEAD INDEPENDENT DIRECTOR

|

| | | | |

| | | | April 4, 2018 |

Dear fellow shareholders:

| | | |

2017 was another strong year for the Firm, on many measures, as we achieved healthy growth across all of our major businesses — adding clients and customers and delivering record earnings per share. Most importantly, the Firm maintained its fortress balance sheet, discipline and client focus, and we continued to build value for our shareholders.

Your Board continues to focus on issues that are important to us and to our shareholders and, because this has been an especially notable year, we would like to highlight a few for you.

To begin, having a first-rate management team in place is one of the highest priorities of the Board. To see that we continue to do so, management succession planning is a key focus of your Board. The independent directors know the Firm’s senior leaders well, through unfettered access and significant interaction and believe that, under all timing scenarios, the Firm has in place several highly capable successors to Jamie and other members of the Operating Committee who are well prepared to meet future challenges. We recently announced that Jamie will continue in his current role for approximately five more years, and that Daniel Pinto, the CEO of our Corporate & Investment Bank, and Gordon Smith, the CEO of Consumer & Community Banking, have been appointed Co-Presidents and Co-Chief Operating Officers. In their new roles, Daniel and Gordon will work with Jamie to help drive critical Firm-wide opportunities. These changes are consistent with the Board’s commitment to succession planning.

The Board has also spent significant time on the Firm’s strategy. The Board reviews and approves the Firm’s Strategic Plan, which defines our strategic priorities and contains management’s annual and multi-year plans to deliver on them. The Firm’s priorities reflect our belief that our business model enhances long-term shareholder value and focus on addressing challenges,

such as accelerating the pace with which we deliver innovation and change. To that end, we have placed a priority on investing in innovation and new technology initiatives that allow us to deliver products and services that are more valuable to our customers.

The Firm’s future success rests on our ability to continue to satisfy the needs of our customers and promote opportunity in our communities, enabling more people to share in the rewards of a growing economy. Earlier this year, we were pleased to announce a $20 billion, five-year comprehensive investment to help our employees, and support job growth and the broader economy. This investment included increasing wages for 22,000 of our employees, expanding our branch network into new U.S. markets, increasing our community-based philanthropic investments to $1.75 billion over five years, increasing small business lending by $4 billion, and accelerating affordable housing lending. The investment is intended to drive inclusive economic growth and help create opportunity for more Americans, and was made possible by the Firm’s strong and sustained business performance, recent changes to the U.S. corporate tax system, and a more constructive regulatory and business environment.

We also remain committed to an effective and efficient risk and control environment. While the Firm has strong controls, we are always striving for continuous improvement. Throughout the past year, the Board has spent significant time on overseeing management’s efforts to continue to strengthen our infrastructure and enhance our controls while improving the client and customer experience. Cyber defense and improving our resiliency against cybersecurity threats remains a key focus at all levels of management within the Firm, and of your Board.

As part of risk management, we also take seriously our responsibility to set the “tone at the top.” The commitment to a strong and healthy culture at JPMorgan Chase remains steadfast. The Board provides direct oversight of the Firm’s Culture and Conduct Program. This year there was continued emphasis on our Business Principles and cultivating a strong, cohesive culture across all levels of the Firm.

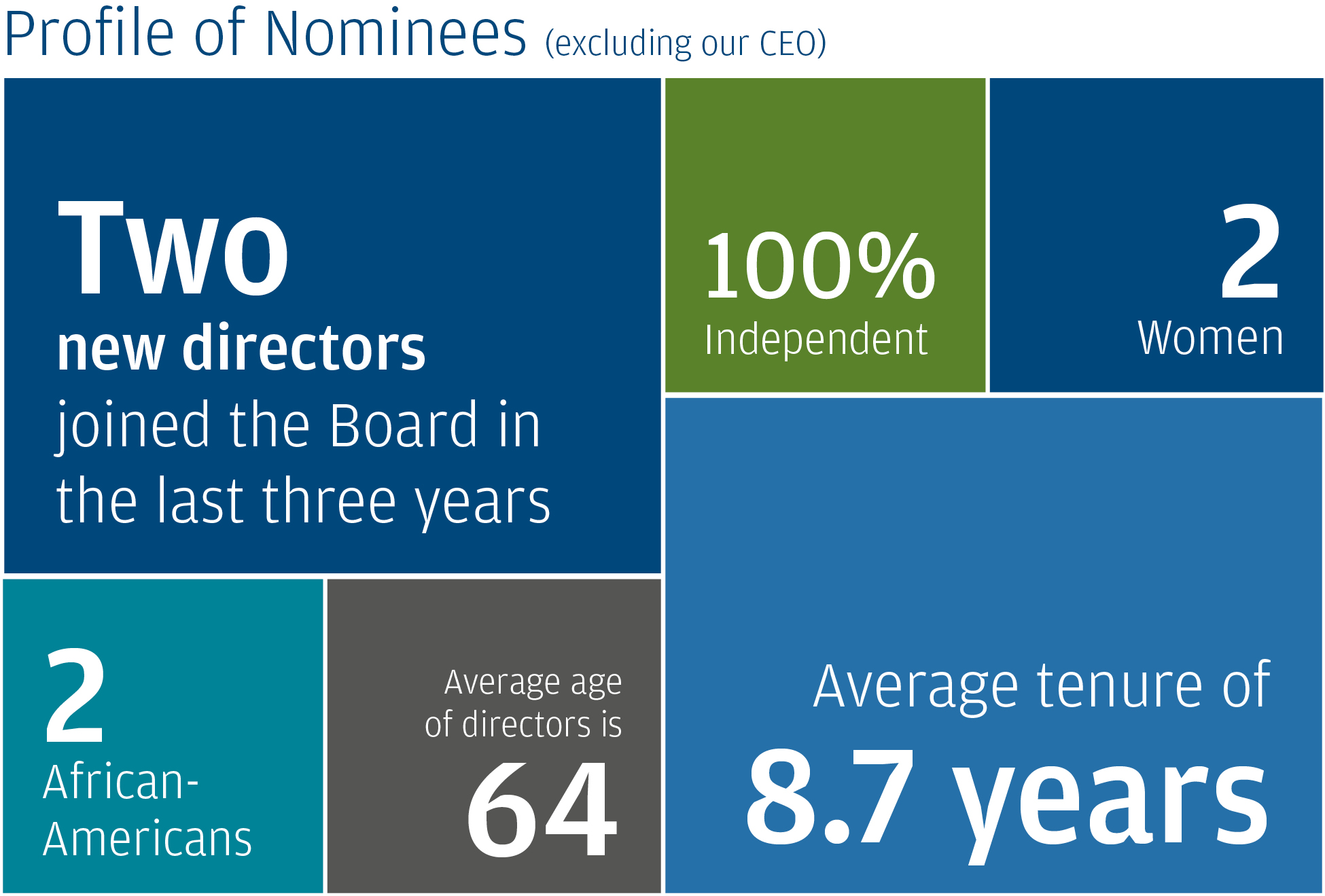

The Board is also very mindful of its own succession planning. We are focused on ensuring that we have the right mix of skills and experiences to align with our business strategy. We conduct an annual board evaluation process and an ongoing review of the Board’s composition and potential candidates. Maintaining an appropriate balance of experience and fresh perspective is also a key focus.

We would like to take this opportunity to thank our friend and colleague, Crandall Bowles, who will be retiring from our Board immediately prior to our Annual Meeting. We have benefited greatly from Crandall’s insights on international business, audit, and risk matters. Her service on the Audit Committee and as Chair of the Public Responsibility Committee has made us a better Board and a better Firm. We will miss her valuable perspective and commitment.

We are pleased to welcome the newest member of our Board, Mellody Hobson, President of Ariel Investments, LLC, whose election in March 2018 reflects the Board’s commitment to seeking out and including top talent with fresh perspectives. Mellody brings to the Board a remarkable combination of skills, experience, and personal qualities that will serve our shareholders, the Firm, and the Board well.

We look forward to continuing to deliver value to our customers, shareholders, and communities. On behalf of all our colleagues on the Board, we are grateful for your support of our Board and the Firm.

|

| | | | |

James Dimon Chairman and Chief Executive Officer | | Lee R. Raymond Lead Independent Director |

|

|

|

Notice of 20172018 Annual Meeting of Shareholders and Proxy Statement

|

| | | | |

| DATE | | Tuesday, May 16, 201715, 2018 | |

| TIME | | 10:00 a.m. EasternCentral Time | |

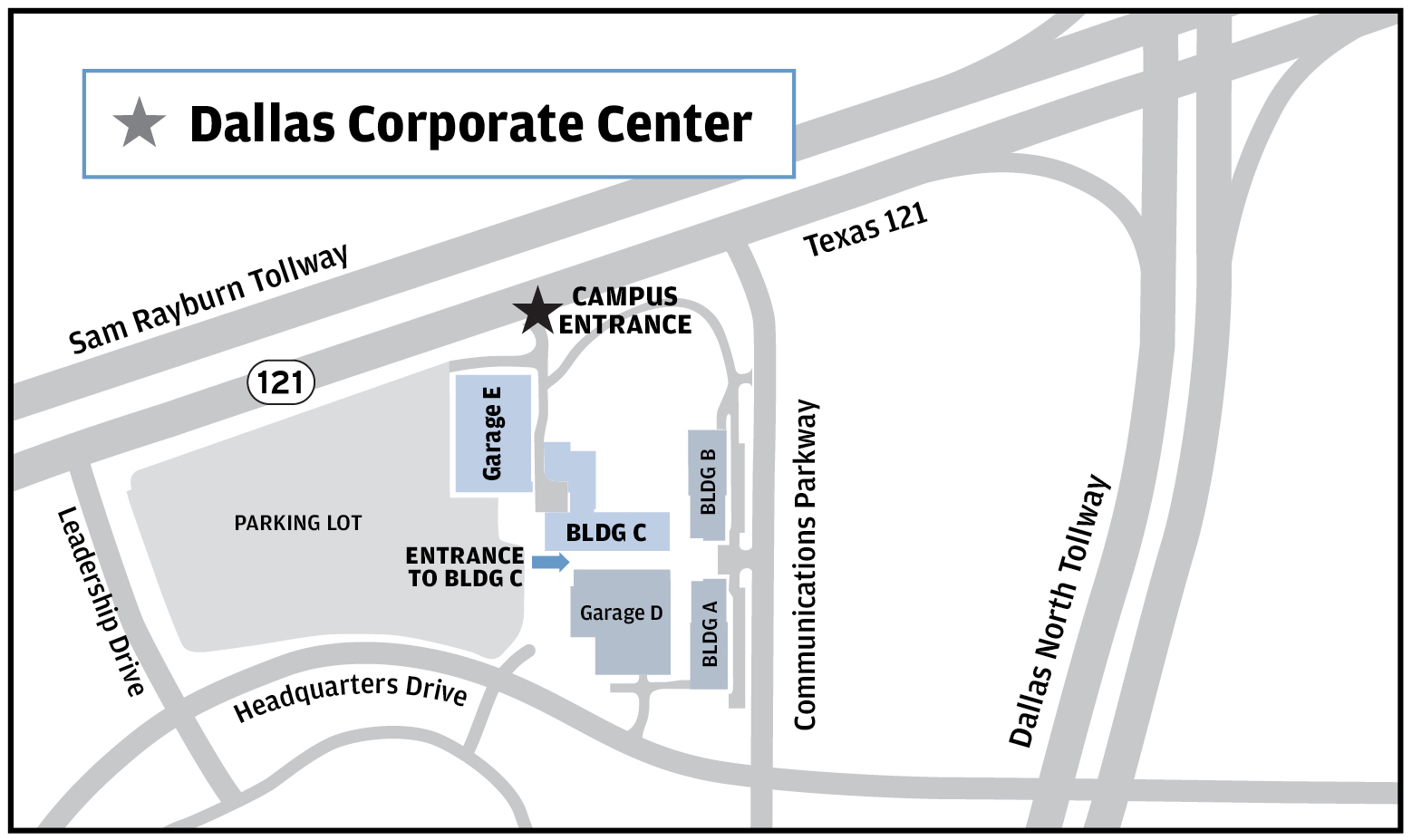

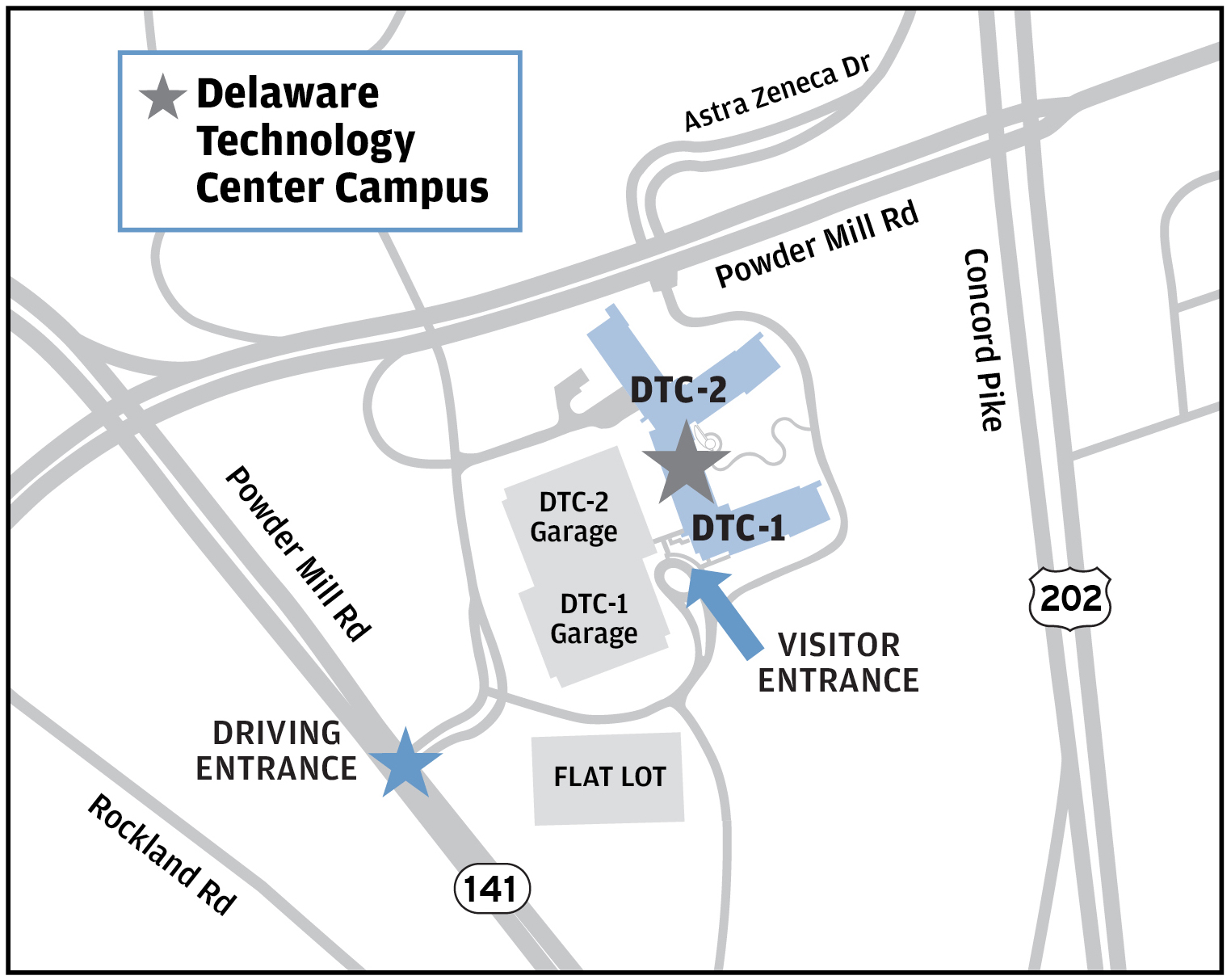

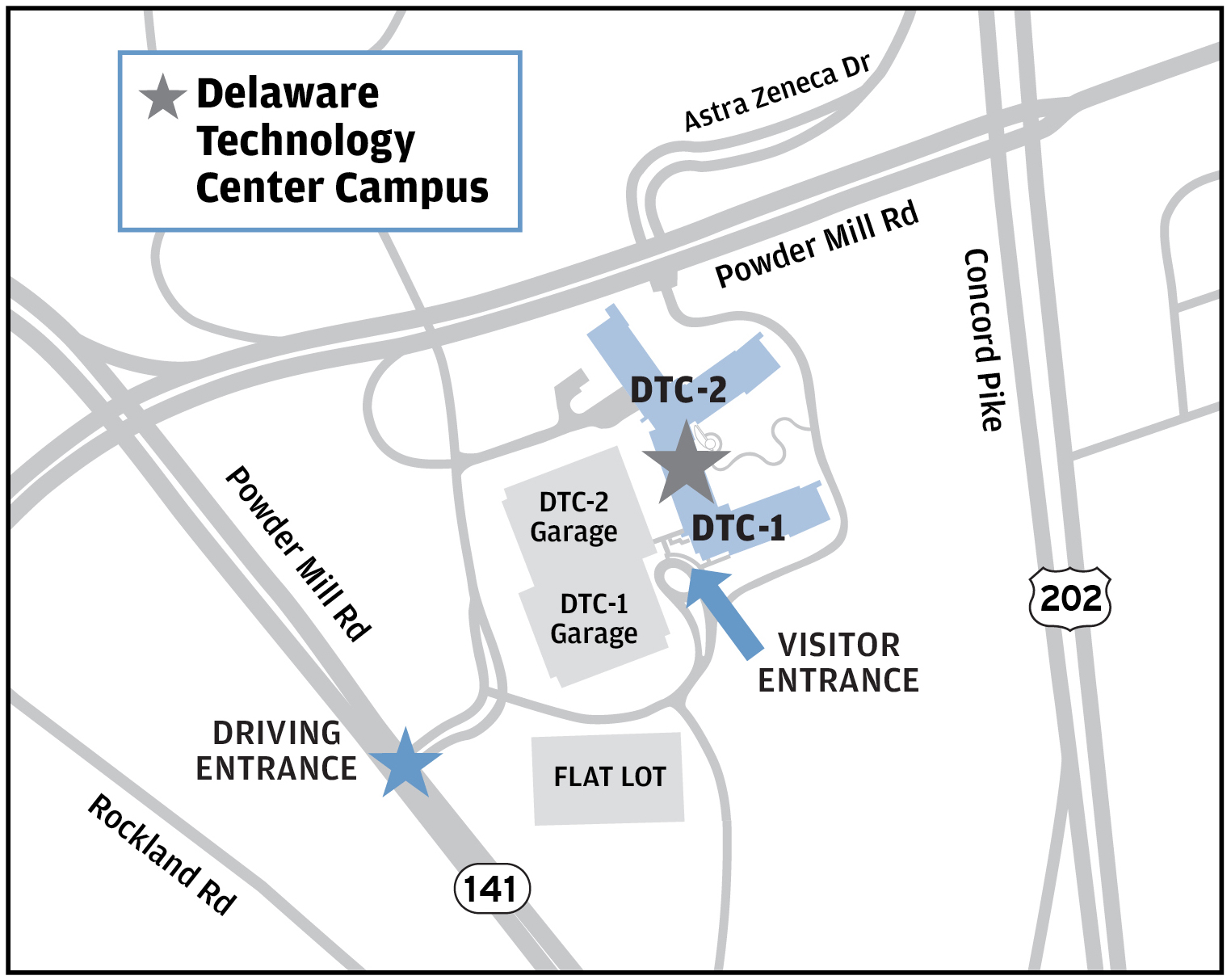

| PLACE | | JPMorgan Chase & Co. Delaware TechnologyDallas Corporate Center 880 Powder Mill Road8181 Communications Parkway

Wilmington, Delaware 19803Plano, Texas 75024

|

| RECORD DATE | | March 16, 2018 |

| | | | |

| MATTERS TO BE | | ln | Election of directors |

| VOTED ON | | ln | Ratification of special meeting provisions in the JPMorgan Chase By-Laws |

| | n | Advisory resolution to approve executive compensation |

| | | ln | Approval of Amended and Restated Long-Term Incentive Plan |

| | n | Ratification of PricewaterhouseCoopers LLP as our independent registered public |

| | | | accounting firm for 20172018 |

| | | l | Advisory vote on frequency of advisory resolution to approve executive compensation |

| | ln | Shareholder proposals, if they are properly introduced at the meeting |

| | | ln | Any other matters that may properly be brought before the meeting |

| | | | |

| | | By order of the Board of Directors |

| | | | | |

| | | Molly Carpenter |

| | | Secretary |

| | | | | |

| | | April 5, 20174, 2018 | |

YOUR VOTE IS IMPORTANT TO US. PLEASE VOTE PROMPTLY.

Please vote promptly.

OnJPMorgan Chase & Co. uses the Securities and Exchange Commission rule permitting companies to furnish proxy materials to their shareholders on the Internet. In accordance with this rule, on or about April 5, 2017,4, 2018, we sent to shareholders of record at the close of business on March 17, 2017, a Proxy Statement, together with an accompanying form of proxy card and Annual Report, or16, 2018, a Notice of Internet Availability of Proxy Materials (“Notice”).

Our 2017, which includes instructions on how to access our 2018 Proxy Statement and 2017 Annual Report online, and how to vote online for the year ended December 31, 2016, are available free of charge on our website at jpmorganchase.com/annual-report-proxy. Instructions on how2018 Annual Shareholder Meeting.

If you received a Notice and would like to receive a printed copy of our proxy materials, areplease follow the instructions for requesting such materials included in the Notice, as well as in this Proxy Statement.proxy statement on page xx of this proxy statement.

If you plan to attend the meeting in person,, you will be required to present a valid form of government-issued photo identification, such as a driver’s license or passport, and proof of ownership of our common stock as of our record date March 17, 2017.16, 2018. See “AttendingInformation about the annual shareholder meeting” on page 98xx of this proxy statement. If you hold your shares in street name and do not provide voting instructions, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote;vote. Of the matters to be voted on at the annual meeting, your broker has discretionary authority to vote only on the ratification of the appointment of the independent registered auditors. See “How votes are counted“What is the voting requirement to approve each of the proposals?” on page 97xx of this proxy statement.

Table of ContentsRECOMMENDATIONS üû

|

| | | |

| Proposal 1 (continued) | |

| |

| |

| |

| |

| |

| |

| |

| | | | |

| Ratification of special meeting provisions in the Firm’s By-Laws | |

| ü |

| |

| |

| |

| |

| |

| Proposal 3: Advisory resolution to approve executive compensation | ü |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

This proxy statement contains forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipate,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “believe,” or other words of similar meaning. Forward-looking statements provide JPMorgan Chase & Co.’s current expectations or forecasts of future events, circumstances, results, or aspirations, and are subject to significant risks and uncertainties. These risks and uncertainties could cause the Firm’s actual results to differ materially from those set forth in such forward-looking statements. Certain of such risks and uncertainties are described in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2017.JPMorgan Chase & Co. does not undertake to update the forward-looking statements included in this proxy statement to reflect the impact of circumstances or events that may arise after the date the forward-looking statements were made.

20172018 Proxy summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information you should consider, and you should read the entire proxy statement carefully before voting.

Proxy statement

Your vote is important. The Board of Directors of JPMorgan Chase & Co. (“JPMorgan Chase” or the “Firm”) is requesting that you allow your common stock to be represented atFor more information on voting and attending the annual meeting, bysee “Information about the proxies

namedannual shareholder meeting” on thepage xx of this proxy card.statement. This proxy statement has been prepared by our management and approved by the Board, and is being sent or made available to our shareholders on or about April 5, 2017.

Annual meeting overview:Matters to be voted on

|

| | |

| ü | MANAGEMENT PROPOSALS | |

The Board of Directors recommends you vote FOR each director nominee and FOR the following proposals (for more information see page referenced): |

| | | |

| 1. Election of directors | |

| | | |

2. Advisory resolution to approve executive compensationRatification of special meeting provisions in the Firm’s By-Laws | |

| | | |

| 3. Advisory resolution to approve executive compensation | |

| | |

| 4. Approval of Amended and Restated Long-Term Incentive Plan | |

| | |

| 5. Ratification of PricewaterhouseCoopers LLP as the Firm’s independent registered public accounting firm | |

| | |

The Board of Directors recommends you select "One Year" on the frequency of the advisory resolution to approve executive compensation (for more information see page referenced):

|

| | |

4. Advisory vote on frequency of advisory resolution to approve executive compensation | |

| | | |

| | | |

| û | SHAREHOLDER PROPOSALS (if they are properly introduced at the meeting) |

The Board of Directors recommends you vote AGAINST each of the following shareholder proposals (for more information see page referenced): |

| | | |

5.6. Independent boardBoard chairman | |

| | |

6. Vesting for government service | |

| | | |

7. Clawback amendmentVesting for government service | |

| | | |

8. Gender pay equity | |

| |

9. How votes are counted | |

| |

10. Special shareowner meetings | |

|

| | |

| 1 | | JPMORGAN CHASE & CO. • 20172018 PROXY STATEMENT• 1

|

|

| | |

| Notable changes since 2017 Annual Meeting |

| | |

| Long-Term U.S. Investment in Employees, Branch Expansion and Local Economic Growth | | Board Refreshment

|

| | |

▪ Announced a $20 billion, five-year comprehensive investment to help employees, and support job and local economic growth in the United States:– Investing in employees with further increases to wages and benefits– Expanding the branch network– Increasing community-based philanthropic investments– Increasing small business lending– Accelerating affordable housing lending | | ▪ Mellody Hobson elected in March 2018, one of two independent directors who joined the Board in the last three years▪ Crandall Bowles, a director since 2016, will retire in May 2018 |

|

| Executive Compensation Program | | Management Succession – Operating Committee Changes |

| | |

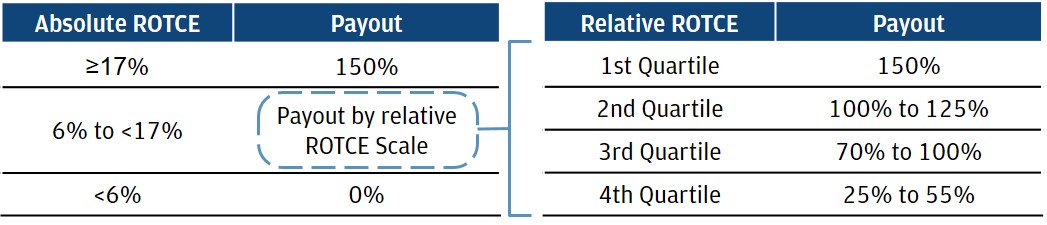

▪ Calibrated the Absolute ROTCE goal for the 2017 PSU award granted in January 2018 to 17%, based on current forecast of future performance▪ Introduced a risk-based capital hurdle to the PSU program referencing the Firm's Fully Phased-in Common Equity Tier 1 capital ratio▪ Updated the stock ownership guideline for Operating Committee members | | ▪ Daniel Pinto and Gordon Smith appointed Co-Presidents and Co-Chief Operating Officers▪ Mary Erdoes, Marianne Lake, and Doug Petno each expanded their responsibilities▪ Three executives joined the Operating Committee:– Lori Beer, Global Chief Information Officer– Robin Leopold, Head of Human Resources– Peter Scher, Global Head of Corporate Responsibility

|

|

| | | | |

| Total shareholder return (“TSR”) |

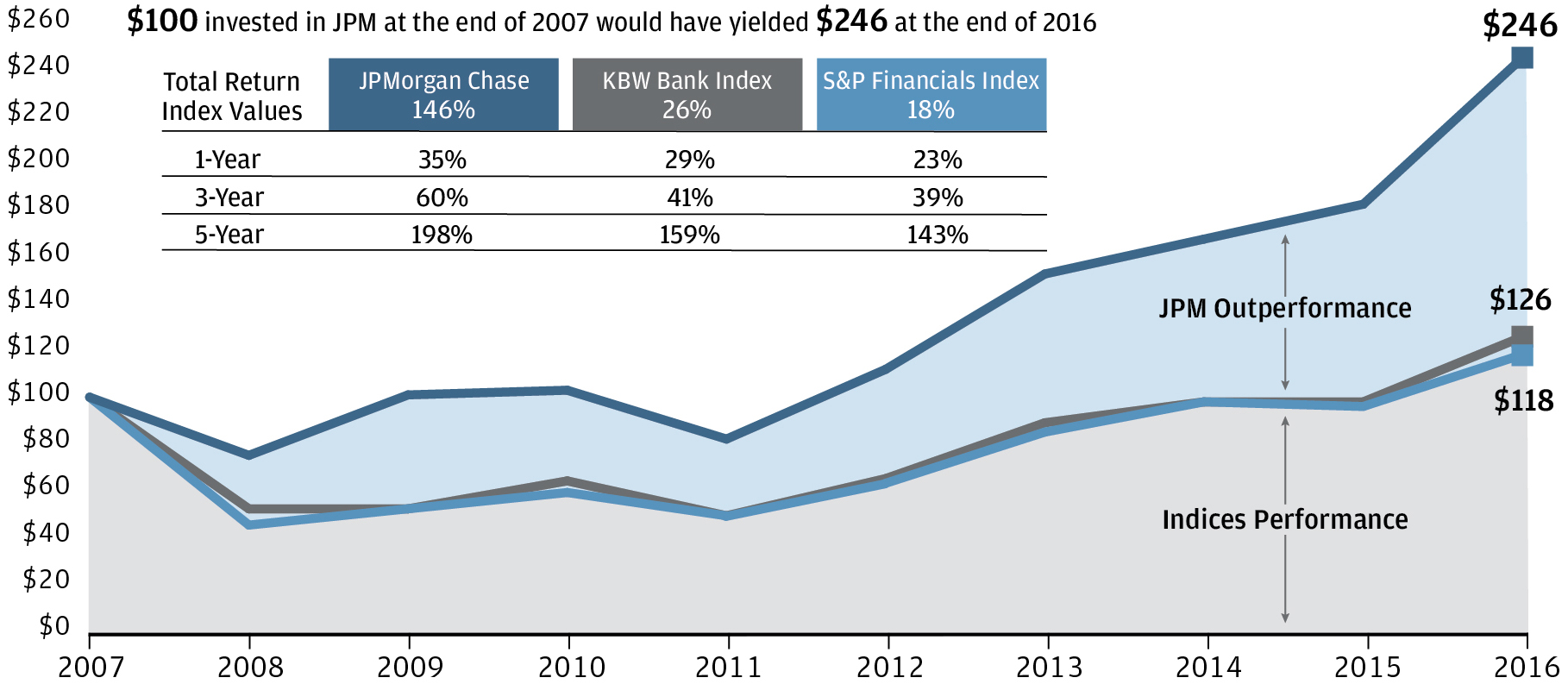

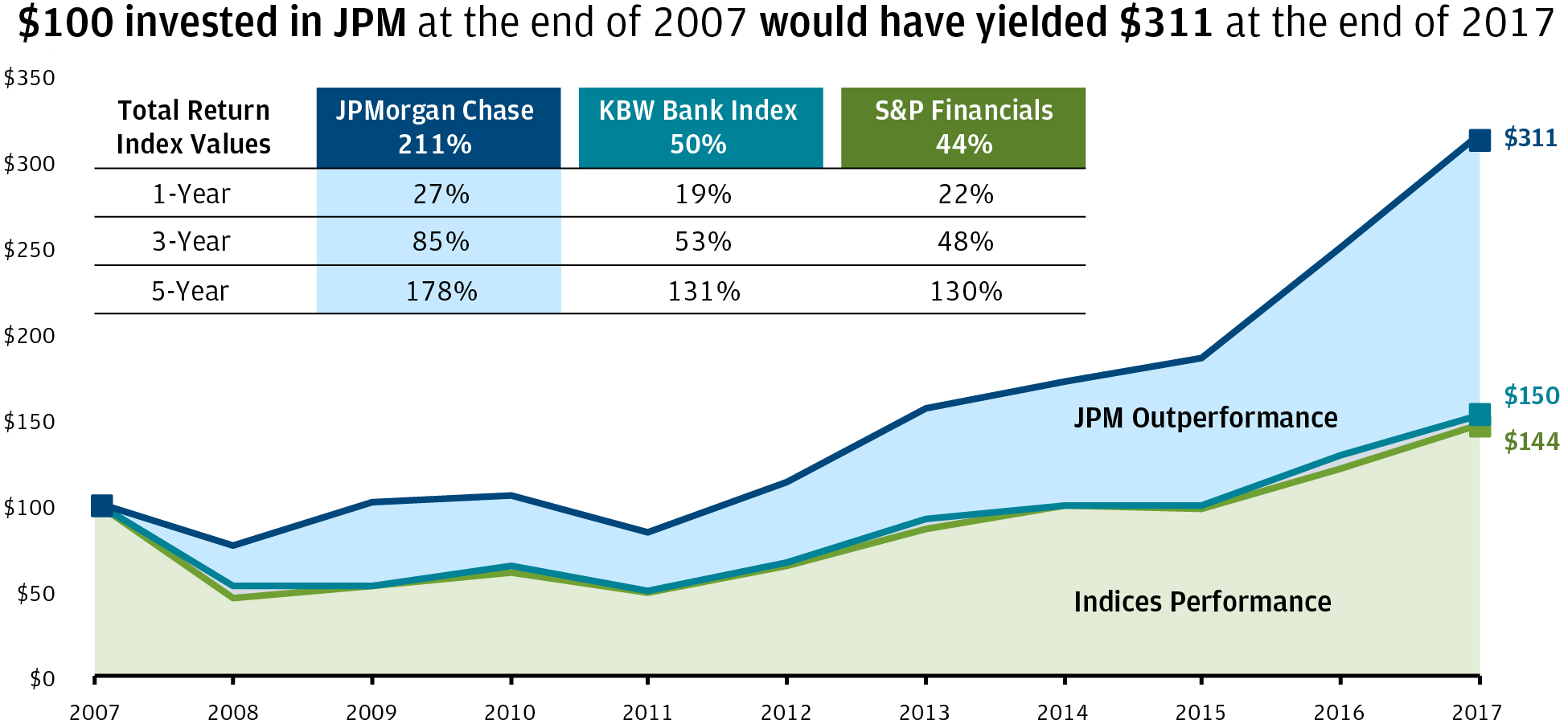

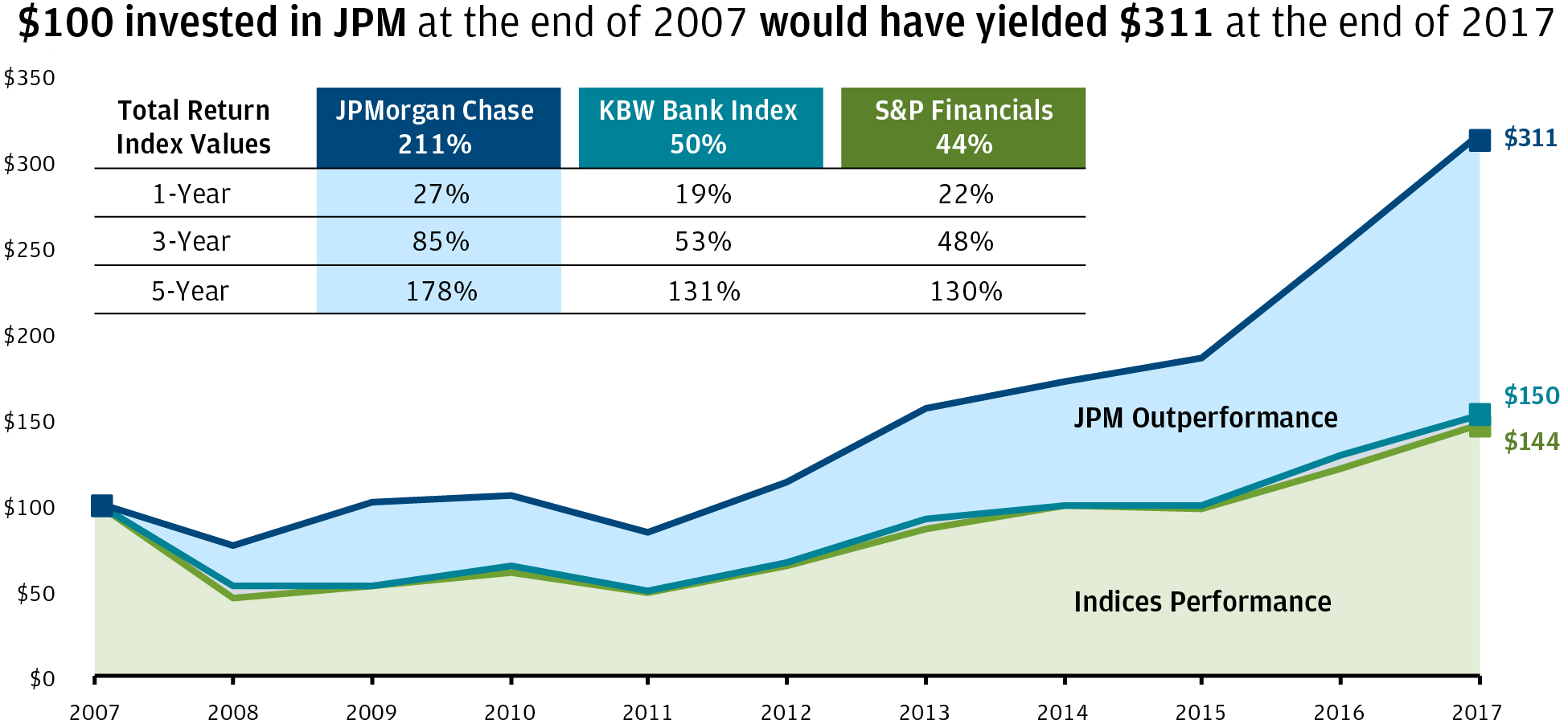

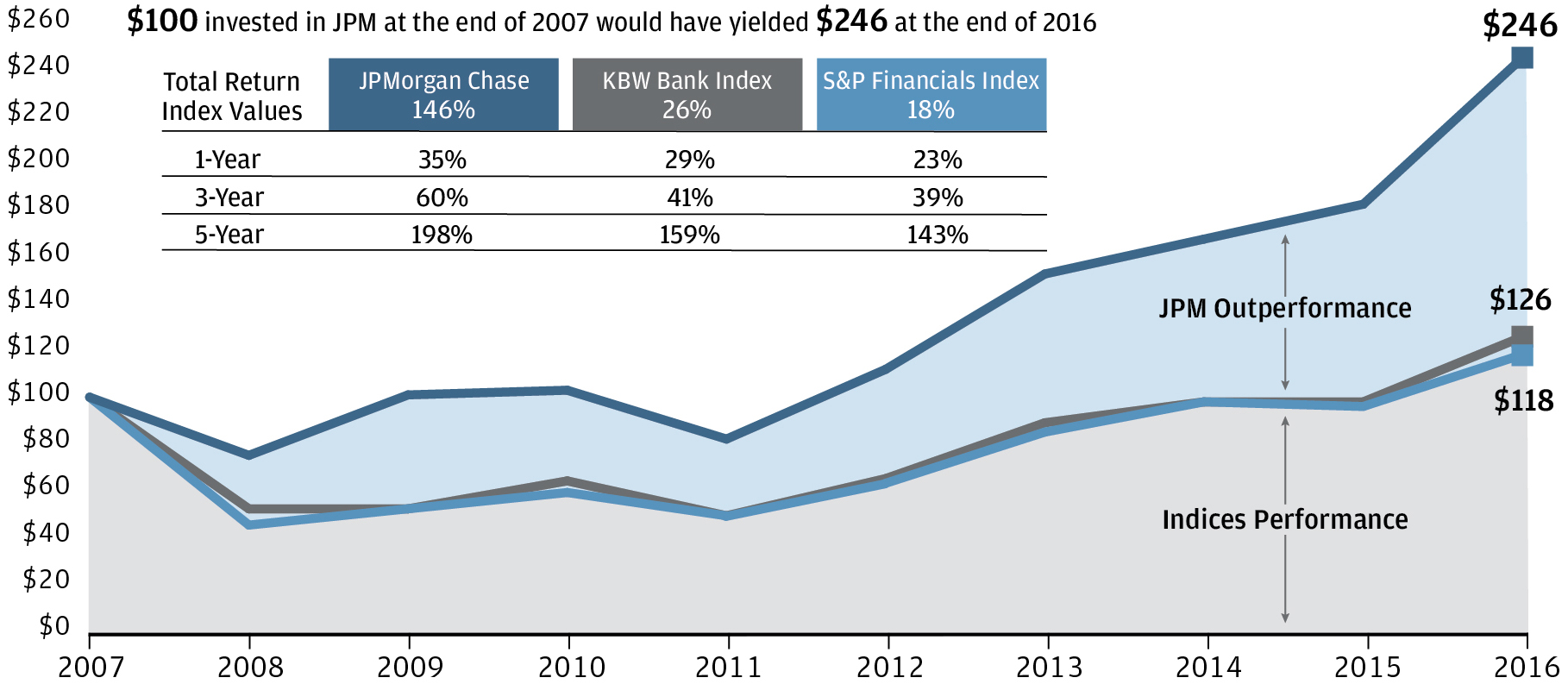

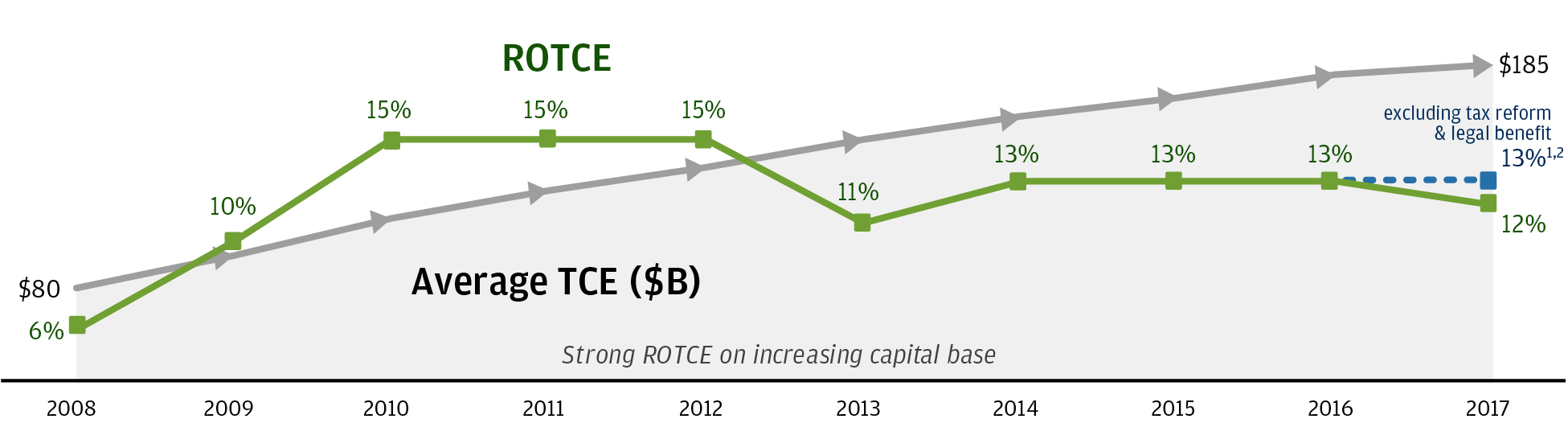

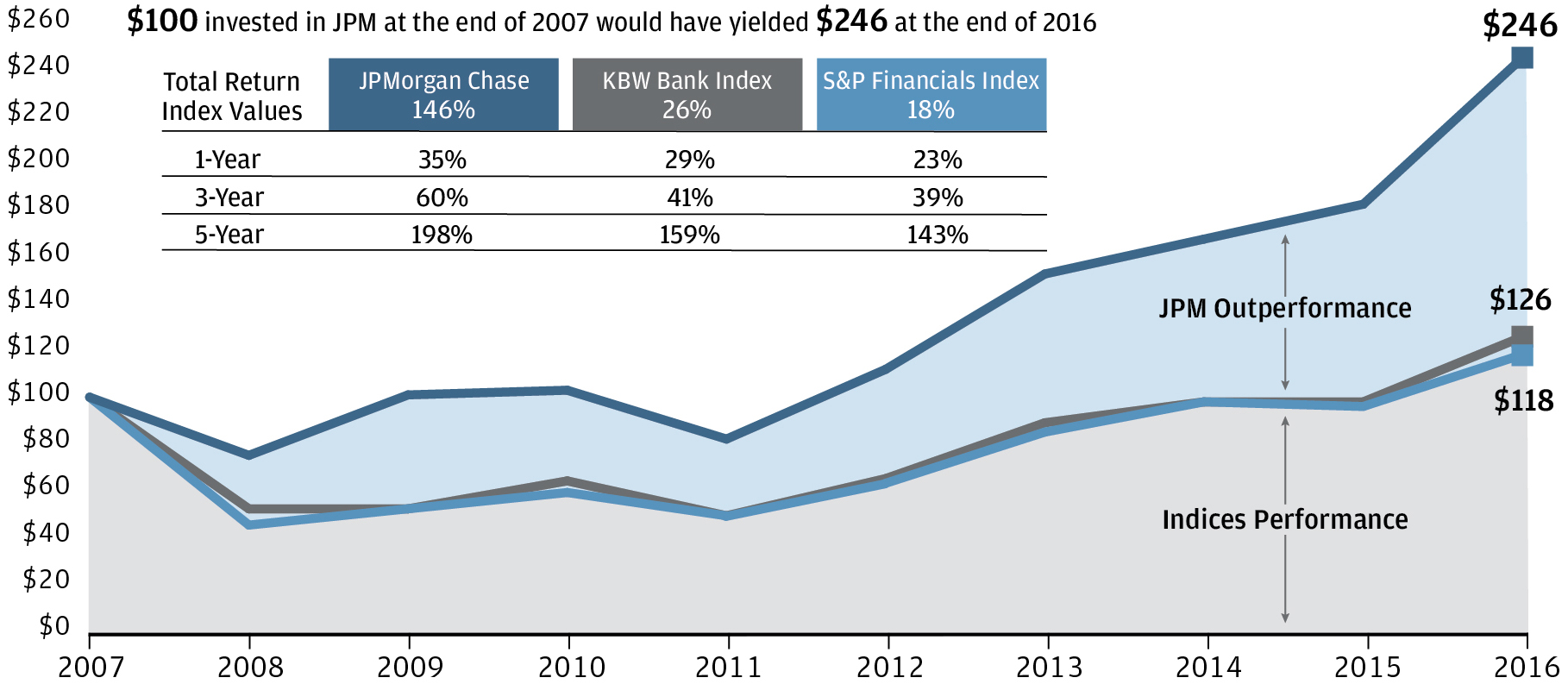

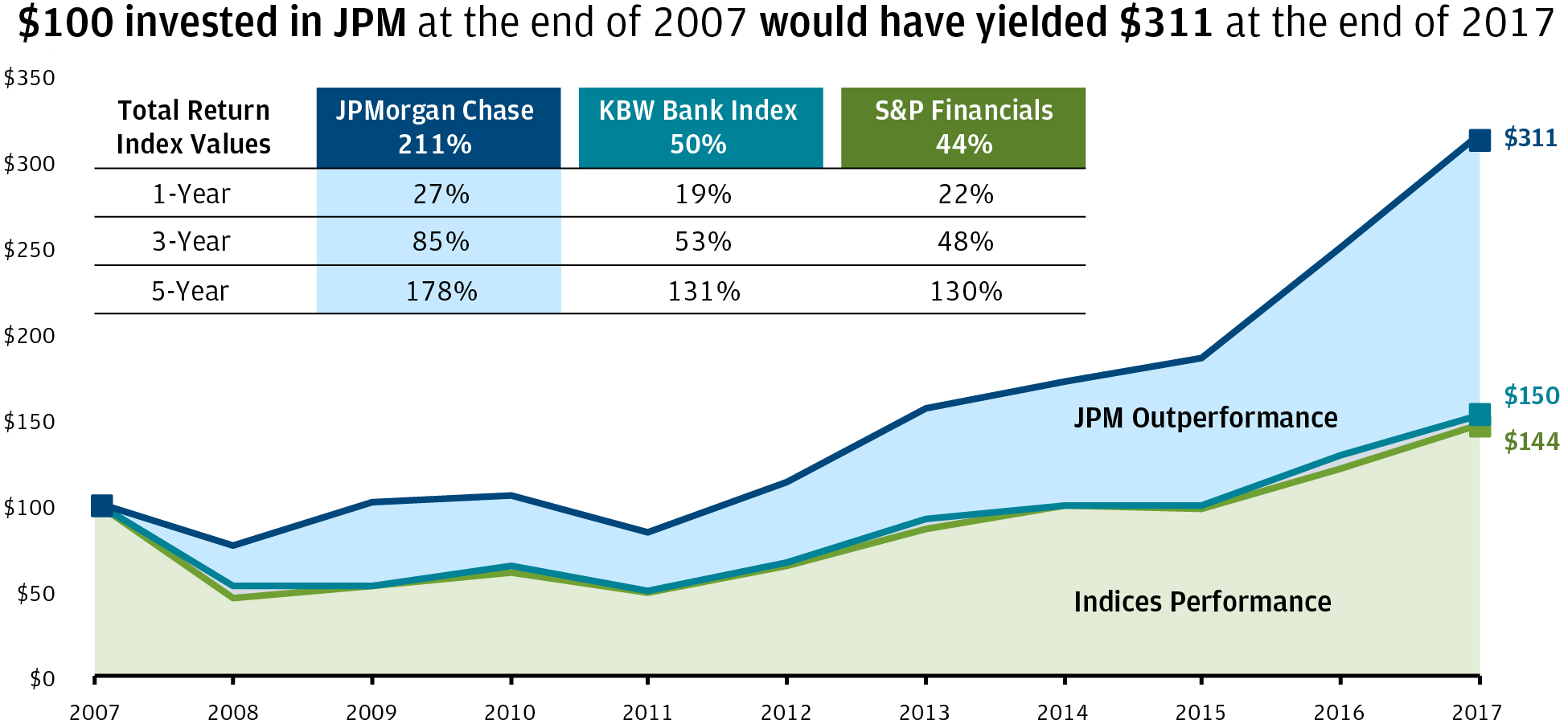

The Firm delivered a TSR1 of 27% in 2017, following a TSR of 35% in 2016 and 8% in 2015, for a combined three-year TSR of 85%. The graph below shows our TSR expressed as cumulative return to shareholders over the past decade. As illustrated below, a $100 investment in JPMorgan Chase on December 31, 2007 would be valued at $311 as of December 31, 2017, significantly outperforming the financial services industry over the period, as measured by the KBW Bank Index and the S&P Financials Index.

1 TSR assumes reinvestment of dividends

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 2 |

|

|

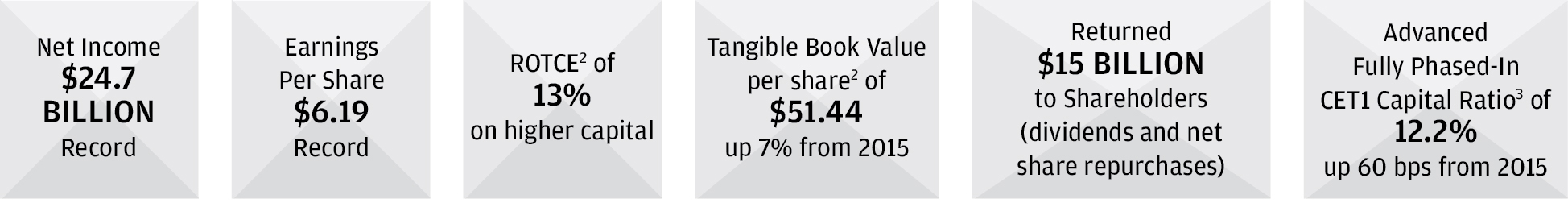

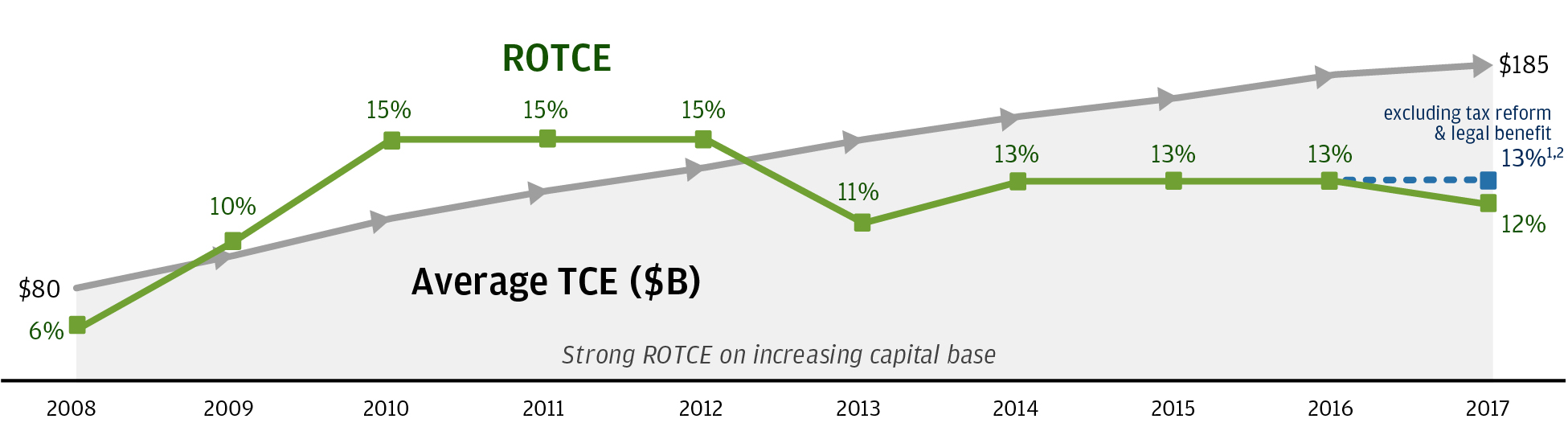

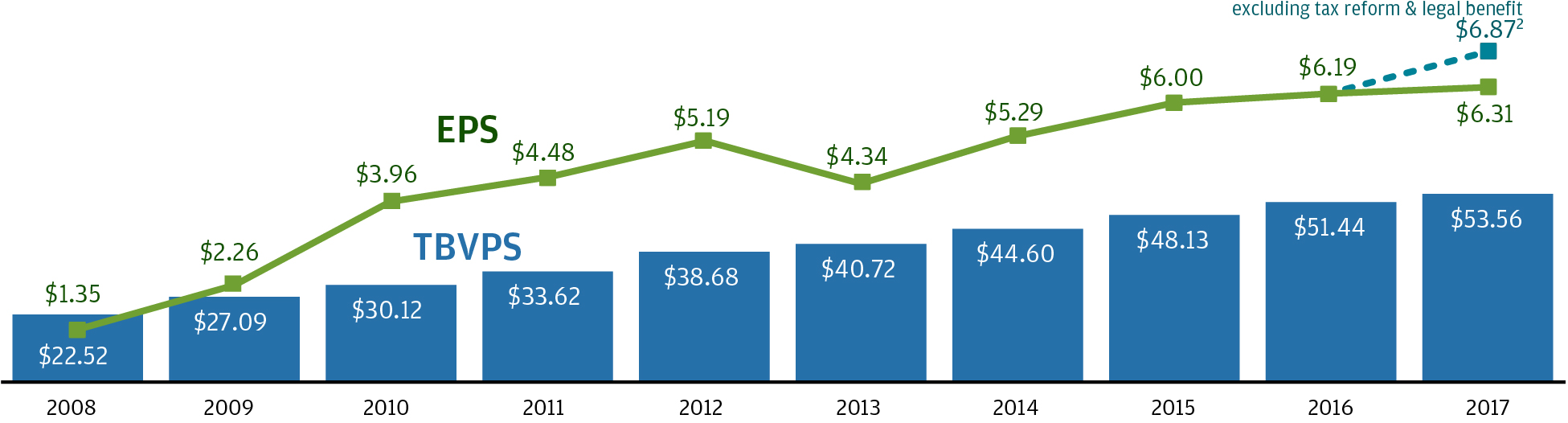

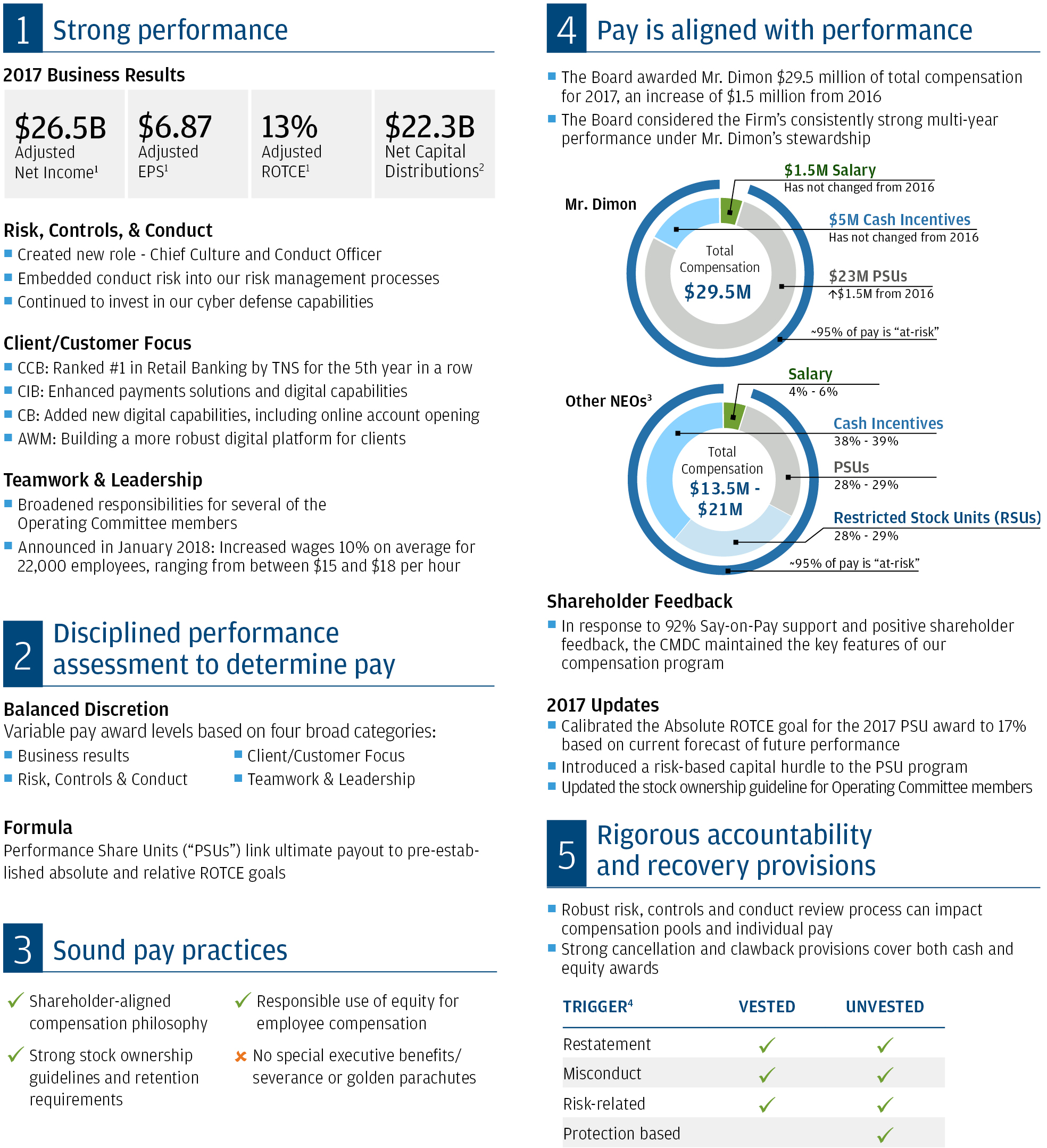

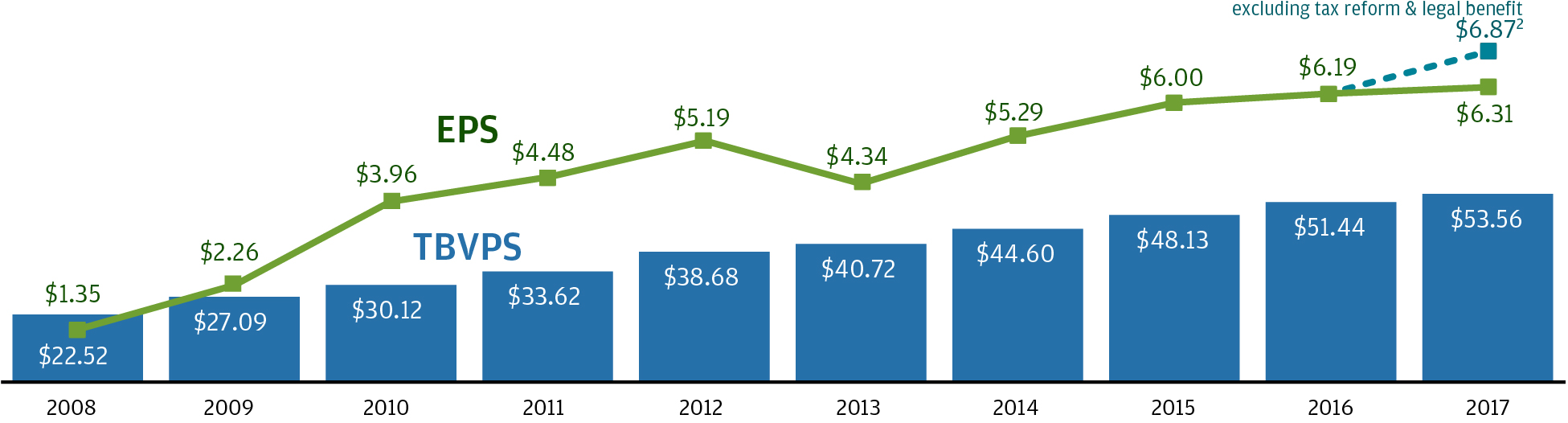

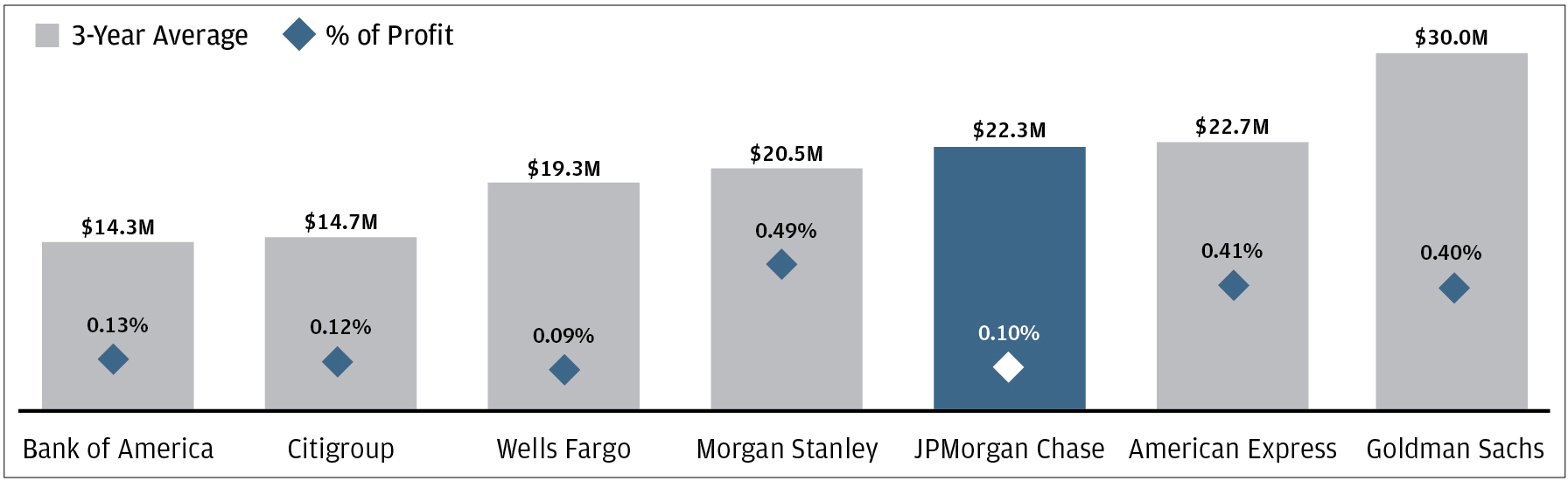

| We demonstrated strong financial performance in 2017 |

In 2017, the Firm delivered net income of $24.4 billion and record earnings per share ("EPS") of $6.31 with return on tangible common equity ("ROTCE")1 of 12%. Excluding the impact of tax reform and a legal benefit, the Firm delivered adjusted net income of $26.5 billion and adjusted EPS of $6.87 with adjusted ROTCE of 13%. We returned $22.3 billion of capital to shareholders (including common dividends and net share repurchases). We also gained market share in nearly all of our businesses, demonstrated strong expense discipline, continued to achieve high customer satisfaction scores, and maintained a fortress balance sheet. |

| | | | | | | | |

Net income of $24.4 BILLION | | EPS of $6.31 | | ROTCE1 of 12% | | Tangible book value per share ("TBVPS")1 of $53.56 - up 4% from 2016 | | Distributed $22.3 BILLION to shareholders |

Excluding the impact of tax reform and a legal benefit: |

| | | | |

Adjusted net income2 of $26.5 BILLION | | Adjusted EPS2 of $6.87 | | Adjusted ROTCE1,2 of 13% |

|

| | | | |

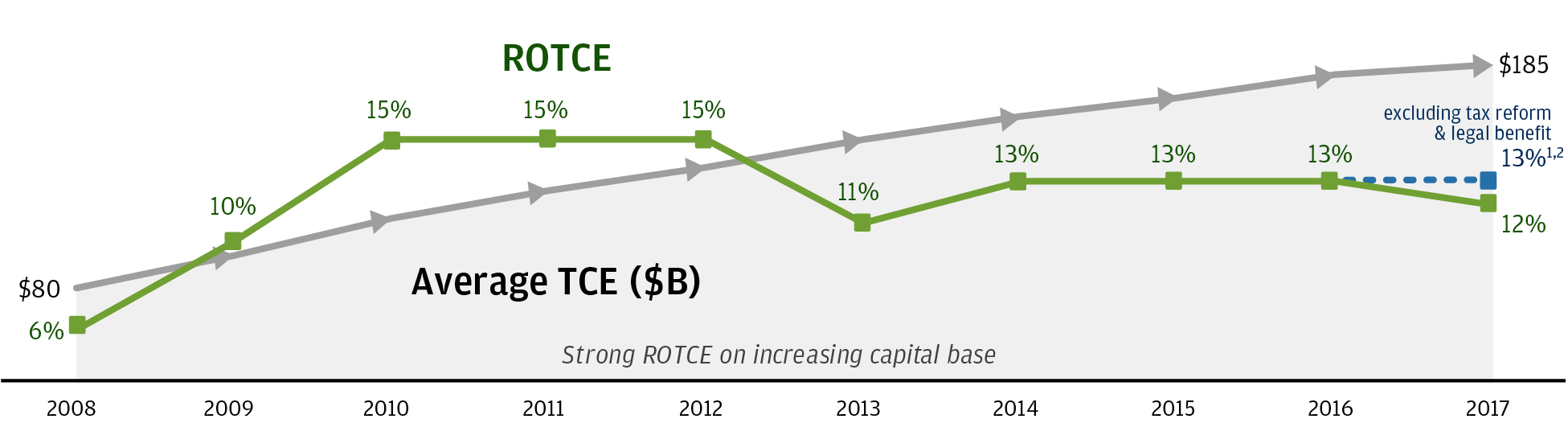

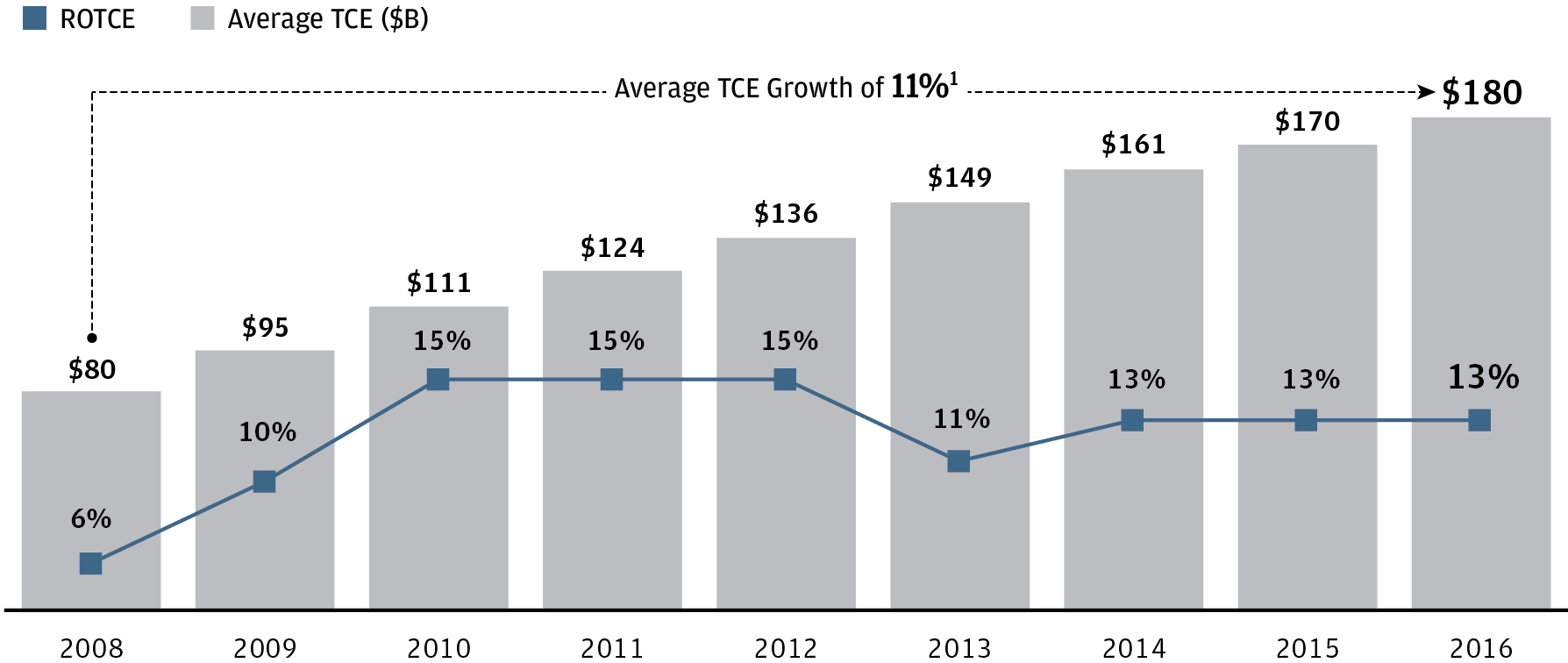

| The Firm has demonstrated sustained long-term financial performance |

We have delivered sustained growth in both TBVPS and EPS over the past 10 years, reflecting compound annual growth rates of 10% and 19%, respectively, over the period.

| |

1 | ROTCE and TBVPS are each non-GAAP financial measures; for a reconciliation and further explanation, see page [xx]. On a comparable U.S. GAAP basis, for 2008 through 2017 respectively, return on equity (“ROE”) was 4%, 6%, 10%, 11%, 11%, 9%, 10%, 11%, 10% and 10%, and book value per share (“BVPS”) was $36.15, $39.88, $42.98, $46.52, $51.19, $53.17, $56.98, $60.46, $64.06 and $67.04. |

| |

2 | Excludes the impact of the enactment of the Tax Cuts and Jobs Act of $2.4 billion (after-tax) and of a legal benefit of $406 million (after-tax). Adjusted net income and adjusted EPS are each non-GAAP financial measures; for further explanation, see page [xx]. |

|

| | |

| 3 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

|

| | | | |

| We are committed to sound commonsense corporate governance practices |

| | | | |

| Our Board provides independent oversight of the Firm’s business and affairs |

| | |

▪ Reviews the strategic priorities▪ Evaluates the CEO’s performance▪ Reviews the Firm’s financial performance and delivery of long-term value to our shareholders | | ▪ Oversees our Culture and Conduct Program▪ Oversees the Firm’s risk management and internal control frameworks |

|

| Our governance practices promote board effectiveness and shareholder interests |

| | |

▪ Annual Board and committee assessment▪ Robust shareholder rights:– right to call a special meeting– right to act by written consent | | ▪ Majority voting for all director elections▪ Stock ownership requirements for directors▪ 100% committee independence▪ Executive sessions of independent directors at each regular Board meeting▪ Board oversight of corporate responsibility/ESG matters |

|

| A robust Lead Independent Director role facilitates independent board oversight of management |

|

▪ The Firm's Corporate Governance Principles require the independent directors to appoint a Lead Independent Director if the role of the Chairman is combined with that of the CEO▪ The Board reviews its leadership structure annually as part of its self-assessment process▪ Responsibilities of the Lead Independent Director include: |

| ü | acts as liaison between independent directors and the CEO | | ü | presides over executive sessions of independent directors

|

| ü | acts as a sounding board to the CEO | | ü | engages and consults with major shareholders and other constituencies, where appropriate

|

| ü | provides advice and guidance to the CEO on executing long-term strategy | | ü | guides annual performance review of the CEO |

| ü | advises the CEO of the Board’s information needs | | ü | guides the annual independent director consideration of CEO compensation |

| ü | meets one-on-one with the CEO at every regularly scheduled Board meeting | | ü | guides full Board consideration of CEO succession |

| ü | has the authority to call for a Board meeting or a meeting of independent directors | | ü | guides the self-assessment of the full Board |

| ü | approves agendas and adds agenda items for Board meetings and meetings of independent directors | | ü | presides at Board meetings in the CEO’s absence or when the CEO or the Board raises a possible conflict of interest |

| | | | |

| We maintain an active engagement with shareholders |

|

▪ We have regular and ongoing discussions with shareholders throughout the year on a wide variety of topics, such as financial performance, strategy, competitive environment, regulatory landscape, and environmental, social & governance matters▪ In 2017, our shareholder engagement initiatives included:– Shareholder Outreach: Hosted more than 80 discussions on strategy, financial performance, governance, executive compensation, and environmental & social matters, among others, with shareholders representing >45% of our outstanding common stock– Annual Investor Day: Senior management gave presentations at our annual Investor Day on strategy and financial performance– Meetings/Conferences: Senior management hosted more than 50 investor meetings and presented at 12 investor conferences– Annual Shareholder Meeting: Our CEO and Lead Independent Director presented to shareholders at the Firm's 2017 annual meeting |

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 4 |

|

| | | | |

| Proposal 1: Election of directors – page xx |

The Board of Directors has nominated the 12 individuals listed below. All are independent other than our CEO. If elected at our annual meeting, all our nominees are expected to serve until next year’s annual meeting.

|

| | | | | | | | | | |

| | | | | | | | | | | |

NOMINEE/DIRECTOR OF JPMORGANCHASE SINCE 1 | | AGE | | PRINCIPAL OCCUPATION | | OTHER PUBLIC COMPANY BOARDS (#) | | COMMITTEE MEMBERSHIP2 |

| | Linda B. Bammann Director since 2013 | | 62 | | Retired Deputy Head of Risk Management of JPMorgan Chase & Co.3 | | 0 | | Directors’ Risk Policy (Chair) |

| | James A. Bell Director since 2011 | | 69 | | Retired Executive Vice President of The Boeing Company | | 3 | | Audit (Chair) |

| | Stephen B. Burke Director since 2004 | | 59 | | Chief Executive Officer of NBCUniversal, LLC | | 1 | | Compensation & Management Development; Corporate Governance & Nominating |

| | Todd A. Combs Director since 2016 | | 47 | | Investment Officer at Berkshire Hathaway Inc. | | 0 | | Directors’ Risk Policy;

Public Responsibility |

| | James S. Crown Director since 2004 | | 64 | | President of Henry Crown and Company | | 1 | | Directors’ Risk Policy |

| | James Dimon Director since 2004 | | 62 | | Chairman and Chief Executive Officer of JPMorgan Chase & Co. | | 0 | | |

| | Timothy P. Flynn Director since 2012 | | 61 | | Retired Chairman and Chief Executive Officer of KPMG | | 3 | | Audit; Public Responsibility |

| | Mellody Hobson2 Director since March 2018

| | 49 | | President of Ariel Investments, LLC

| | 2 | | |

| | Laban P. Jackson, Jr. Director since 2004 | | 75 | | Chairman and Chief Executive Officer of Clear Creek Properties, Inc. | | 0 | | Audit |

| | Michael A. Neal Director since 2014 | | 65 | | Retired Vice Chairman of General Electric Company and Retired Chairman and Chief Executive Officer of GE Capital | | 0 | | Directors’ Risk Policy |

| | Lee R. Raymond (Lead Independent Director) Director since 2001 | | 79 | | Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation | | 0 | | Compensation & Management Development (Chair); Corporate Governance & Nominating |

| | William C. Weldon Director since 2005 | | 69 | | Retired Chairman and Chief Executive Officer of Johnson & Johnson | | 2 | | Compensation & Management Development; Corporate Governance & Nominating (Chair) |

| |

1 | Director of a heritage company of the Firm as follows: Bank One Corporation: Mr. Burke (2003–2004), Mr. Crown (1996–2004), Mr. Dimon, Chairman of the Board (2000–2004), and Mr. Jackson (1993–2004); First Chicago Corp.: Mr. Crown (1991–1996); and J.P. Morgan & Co. Incorporated: Mr. Raymond (1987–2000). |

| |

2 | Principal standing committee. Ms. Bowles, who is not standing for re-election this year, is currently Chair of the Public Responsibility Committee; a new chair for 2018 will be elected by the Board following the annual meeting. Ms. Hobson will begin service on Board committee following the annual meeting. |

| |

3 | Retired from JPMorgan Chase & Co. in 2005. |

|

| | |

| 5 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

|

| | | | |

| Proposal 2: Ratification of special meeting provisions in the Firm’s By-Laws – page xx |

In 2017, as part of our engagement discussions with shareholders, we requested feedback about our By-Law provisions regarding shareholders’ rights to call a special meeting. While most shareholders expressed support for the right to call a special meeting if an appropriate threshold of shareholders requested it, there were varying opinions regarding what that appropriate threshold should be. Accordingly, and in lieu of a shareholder proposal seeking to reduce the threshold, the Board is seeking shareholder ratification of the special meeting provisions in the Firm's By-Laws which include a threshold providing that holders of at least 20% of the outstanding shares have the right to call a special meeting. |

| | | | |

| Proposal 3: Advisory resolution to approve executive compensation – page xx |

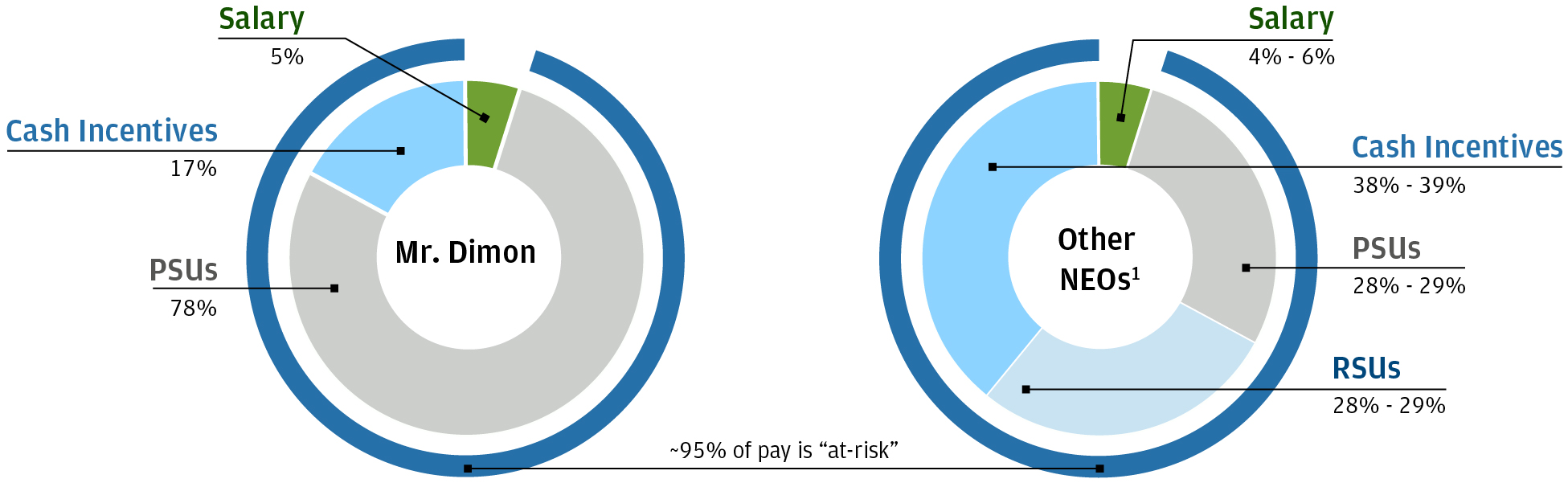

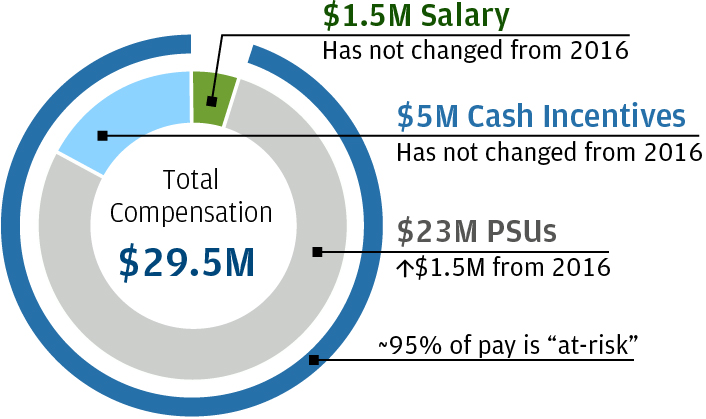

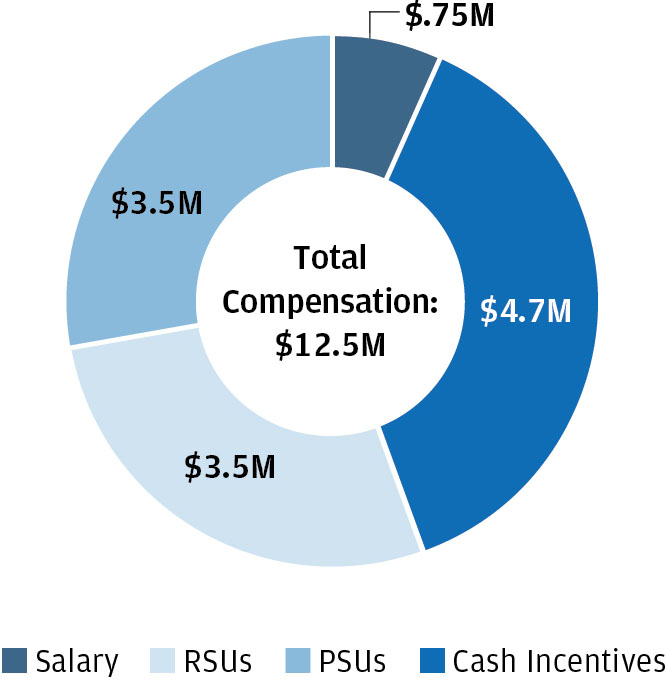

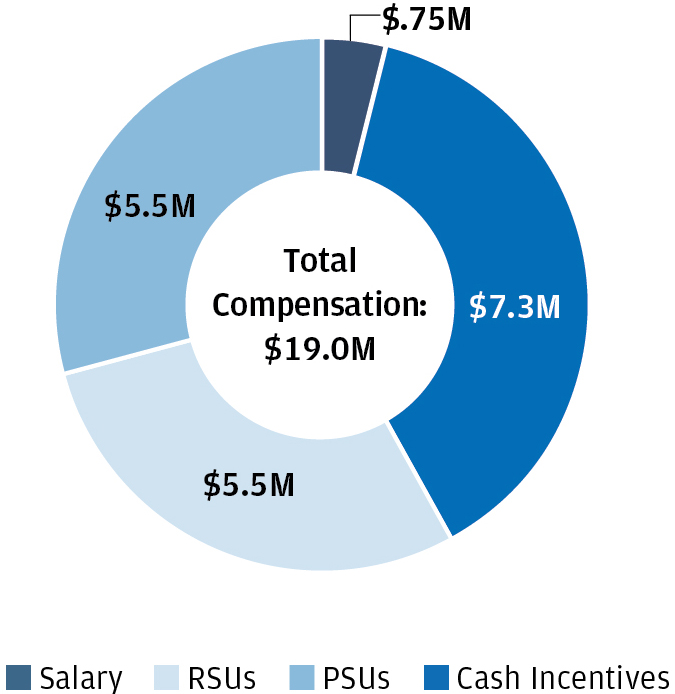

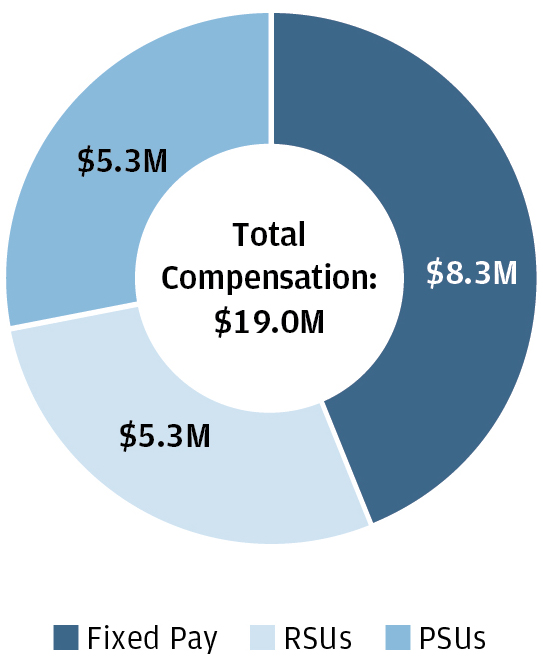

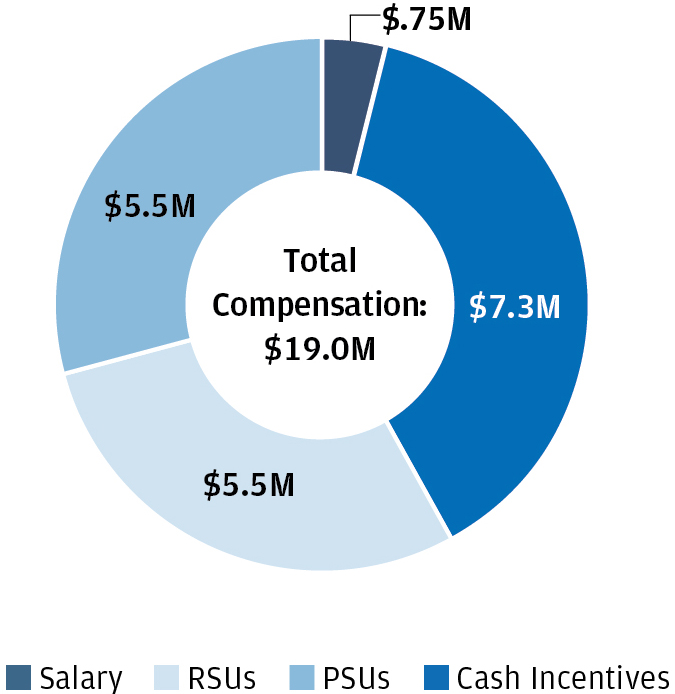

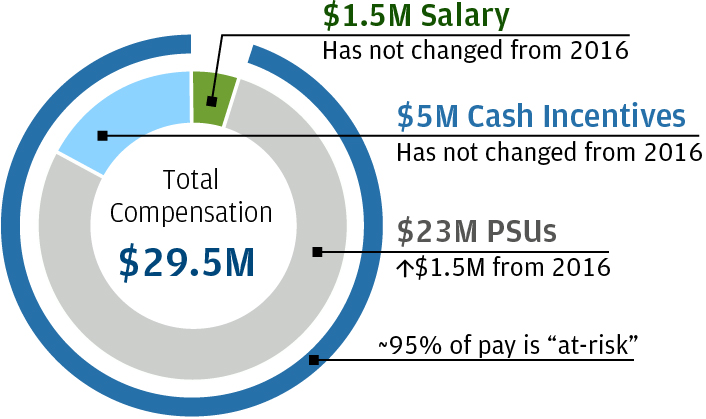

We are submitting an advisory resolution to approve the executive compensation of our Named Executive Officers (“NEOs”). The table below is a summary of the 2017 compensation of our NEOs. |

| | | | | | | | | | | | | | | |

Name and principal position | | INCENTIVE COMPENSATION | |

| Salary |

| Cash |

| Restricted stock units |

| Performance share units |

| Total |

|

| | | | | | |

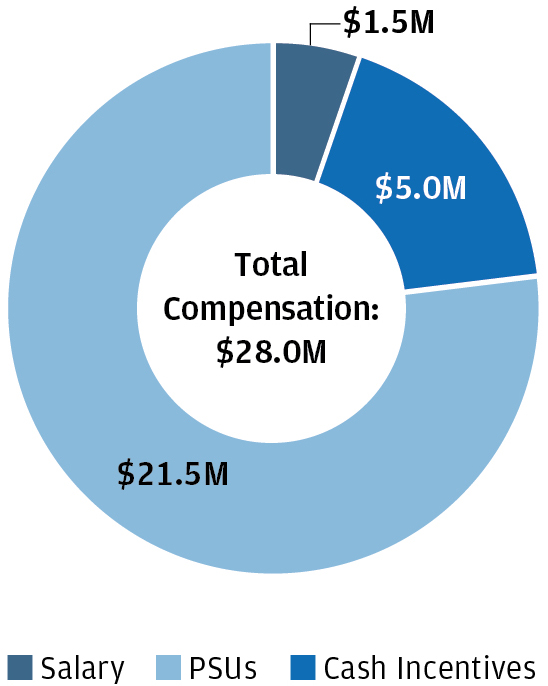

James Dimon Chairman and CEO | $ | 1,500,000 |

| $ | 5,000,000 |

| $ | — |

| $ | 23,000,000 |

| $ | 29,500,000 |

|

Marianne Lake Chief Financial Officer | 750,000 |

| 5,100,000 |

| 3,825,000 |

| 3,825,000 |

| 13,500,000 |

|

Mary Callahan Erdoes CEO Asset & Wealth Management | 750,000 |

| 7,500,000 |

| 5,625,000 |

| 5,625,000 |

| 19,500,000 |

|

Daniel Pinto1 CEO Corporate & Investment Bank | 8,238,628 |

| — |

| 6,380,686 |

| 6,380,686 |

| 21,000,000 |

|

Gordon Smith CEO Consumer & Community Banking | 750,000 |

| 7,700,000 |

| 5,775,000 |

| 5,775,000 |

| 20,000,000 |

|

|

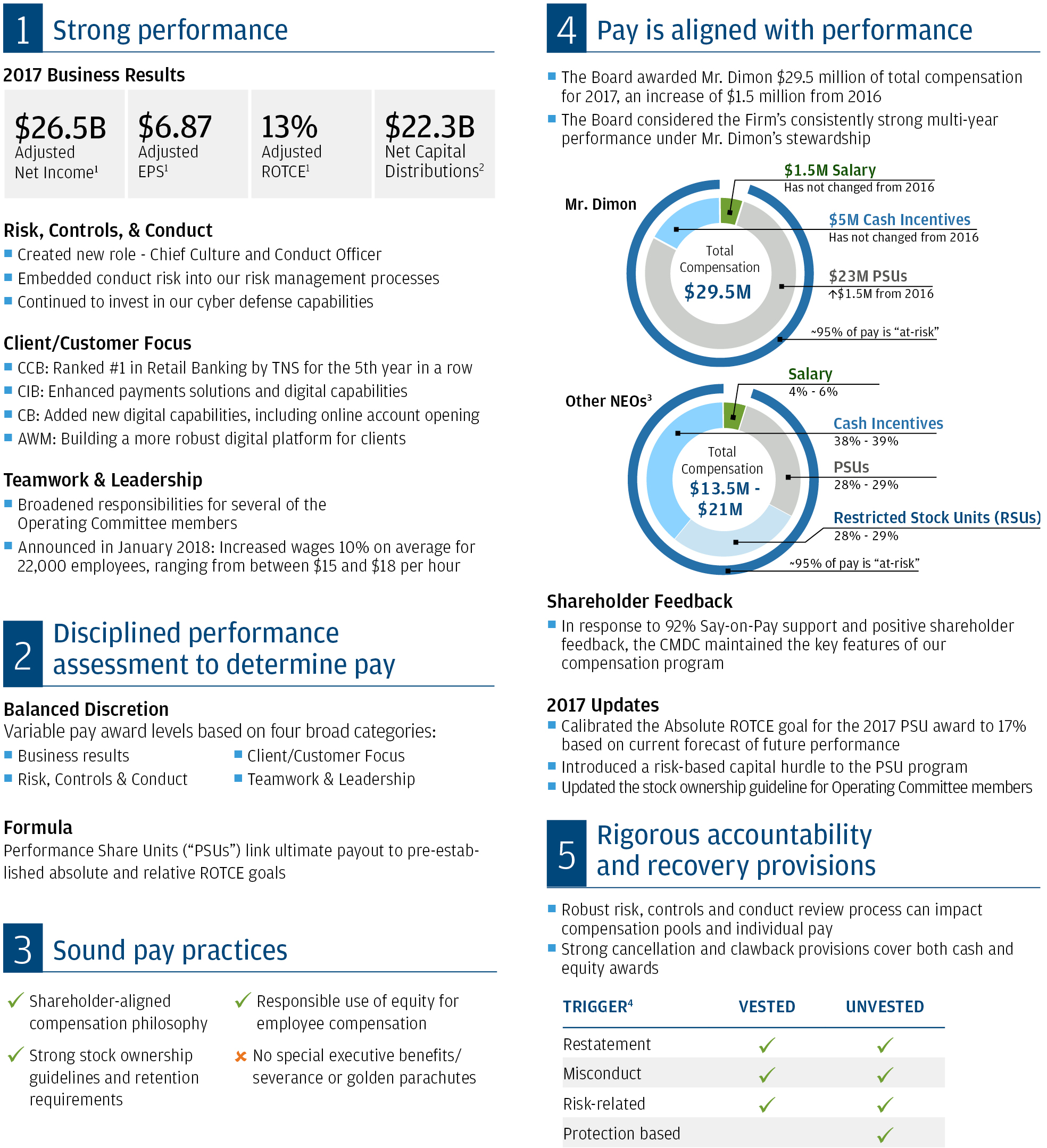

| | | | |

In response to last year’s 92% Say-on-Pay support and positive shareholder feedback, the Compensation & Management Development Committee ("CMDC") maintained the key features of our compensation program. We believe shareholders should consider five key factors in their evaluation of this year’s proposal:

|

1. Strong performance

We continued to deliver strong multi-year financial performance, invest in our future, strengthen our risk and control environment, reinforce the importance of our culture and values, deliver on our long-standing commitment to serve our communities, and conduct business in a responsible way to drive inclusive growth.

2. Disciplined performance assessment to determine pay

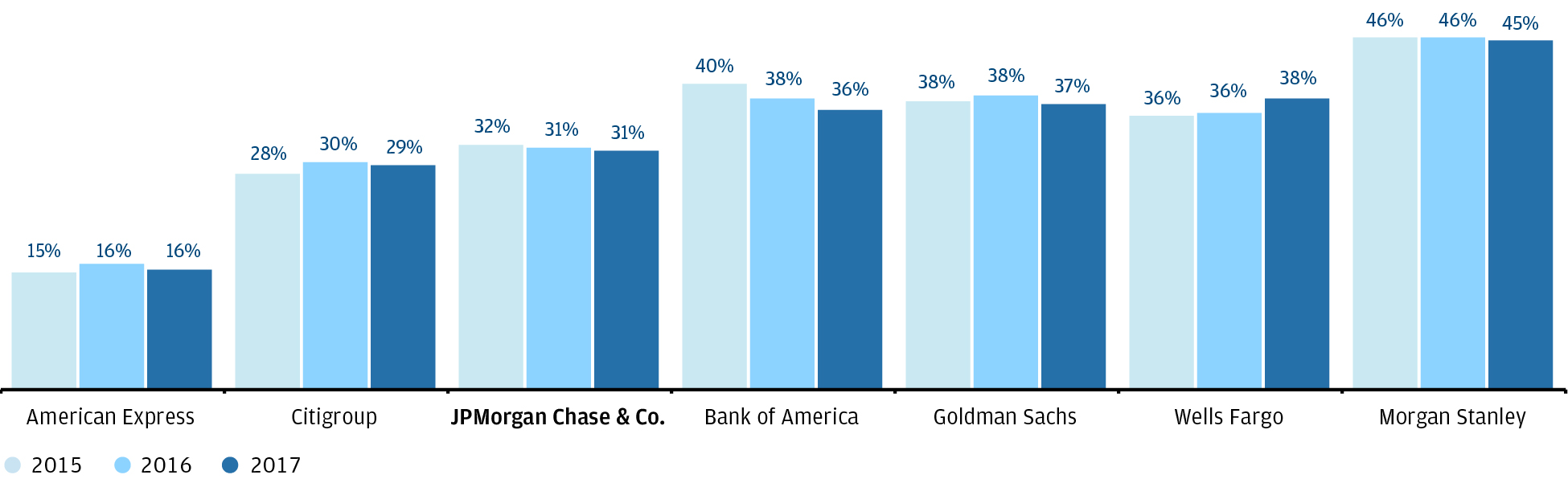

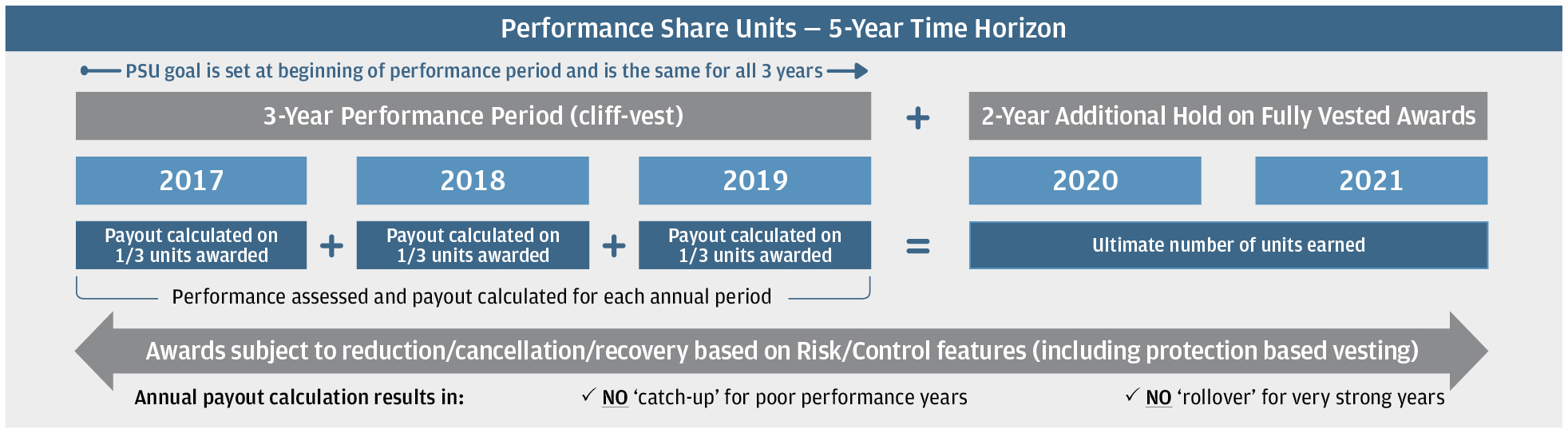

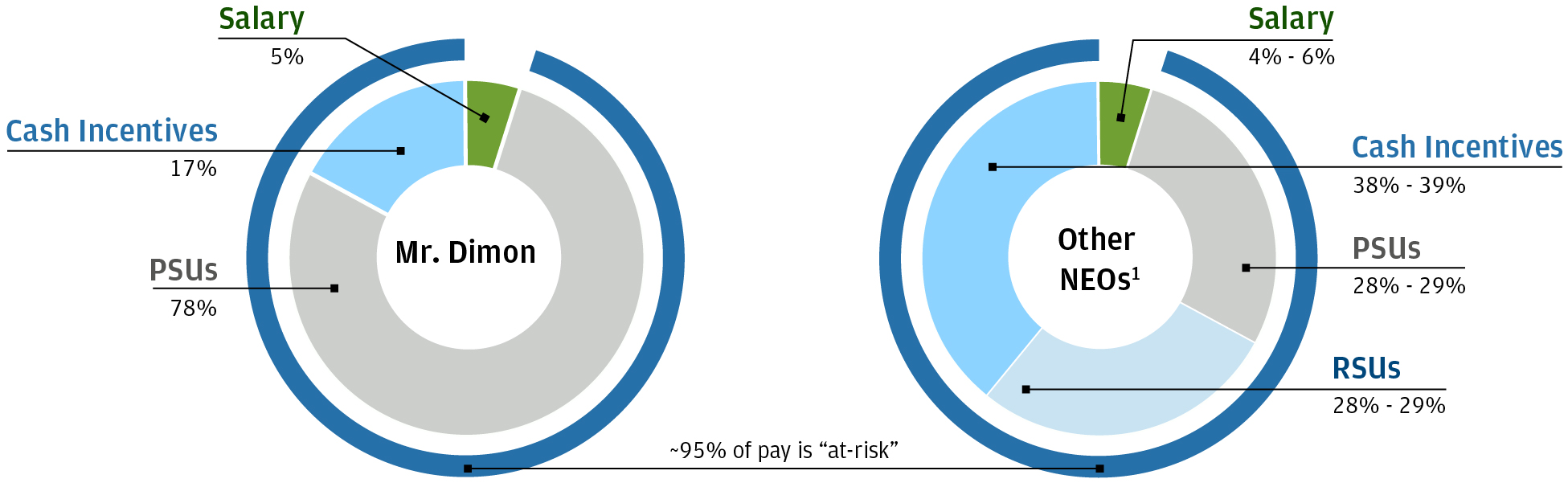

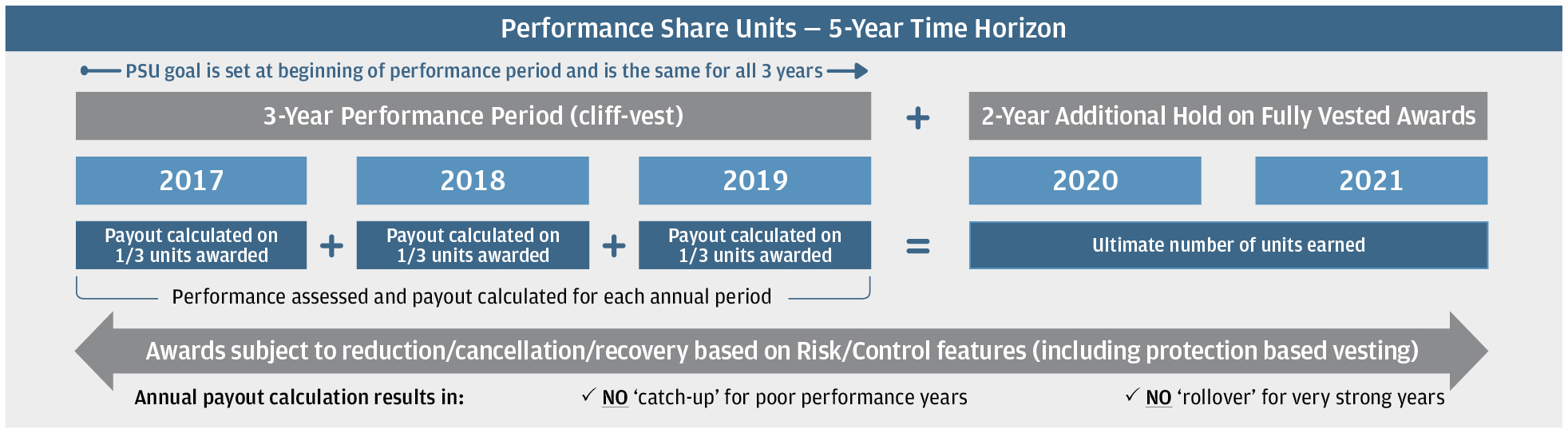

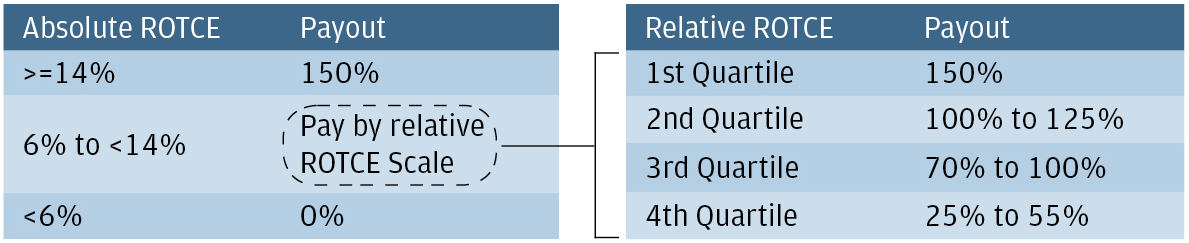

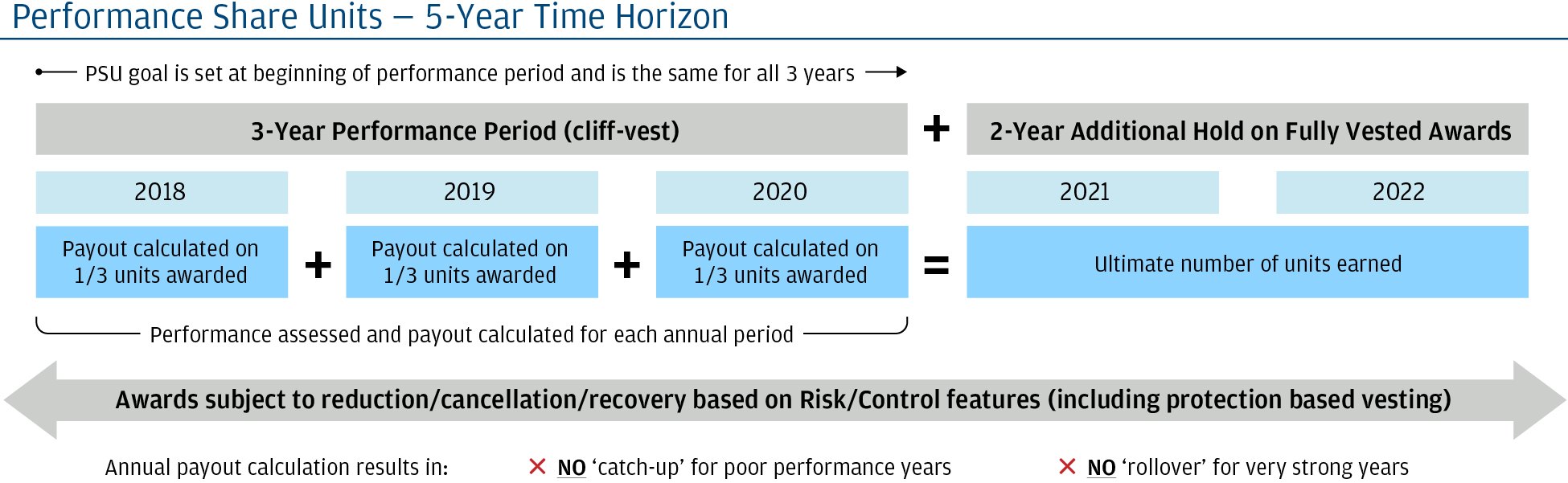

The CMDC uses a balanced approach to determine annual compensation by assessing performance against four broad performance categories over a sustained period of time. A material portion of Operating Committee member compensation is delivered in the form of at-risk Performance Share Units ("PSUs"), reinforcing accountability and alignment with shareholder interests by linking the ultimate payout to pre-established absolute and relative goals.

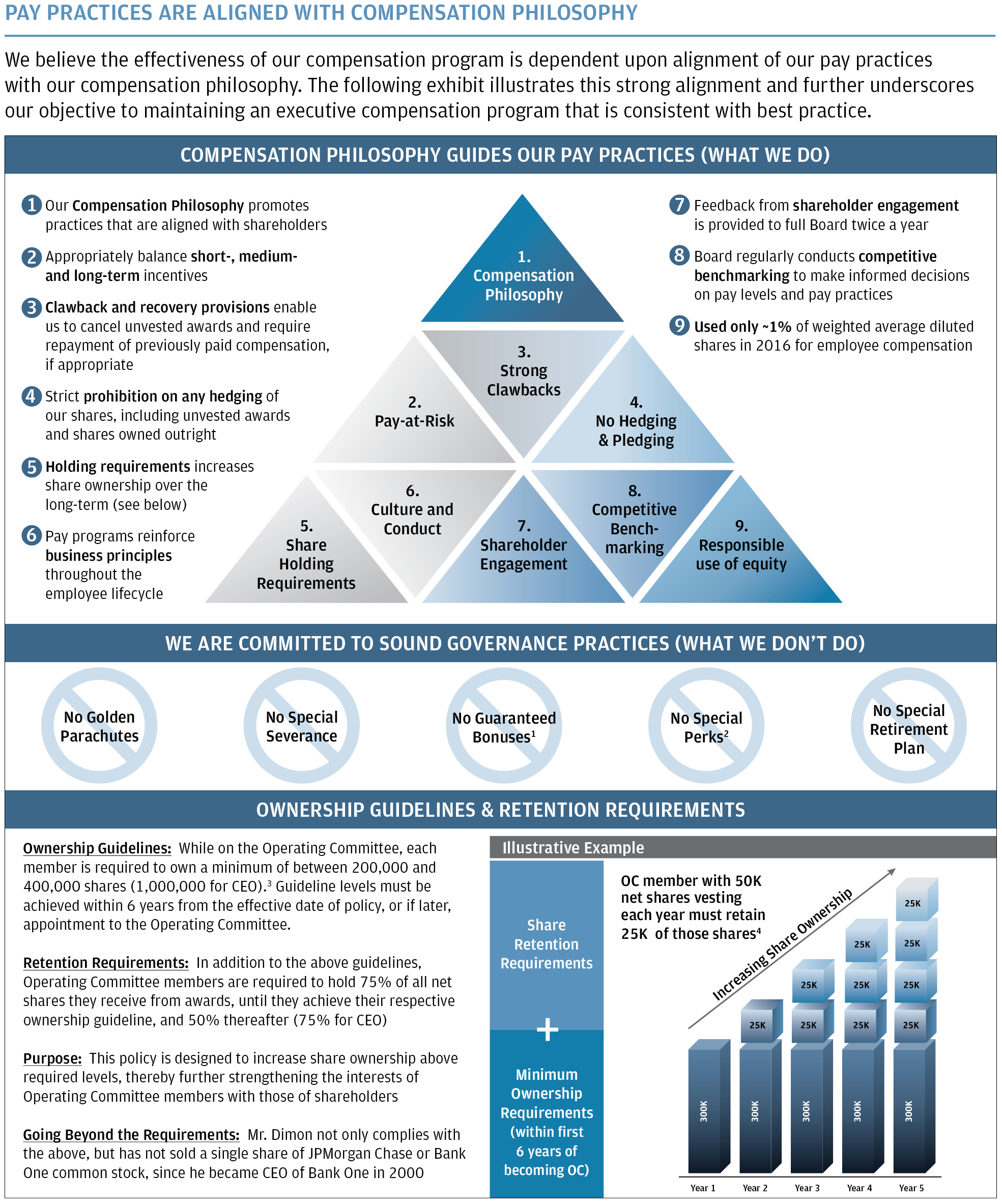

3. Sound pay practices

We believe our compensation philosophy promotes an equitable and well-governed approach to compensation, including pay practices that attract and retain top talent, are responsive to and aligned with shareholders, and encourage a shared success culture in support of our business principles.

4. Pay is aligned with performance

CEO pay is strongly aligned to the Firm’s short-, medium- and long-term performance, with approximately 80% of the CEO’s variable pay deferred into equity, of which 100% is in PSUs. Other NEO pay is also strongly tied to Firm and line of business performance, with a majority of variable pay deferred into equity, of which 50% is in PSUs.

5. Rigorous accountability and recovery provisions

Our executive compensation program is designed to hold executives accountable, when appropriate, for meaningful actions or issues that negatively impact business performance in current or future years.

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 6 |

|

| | | | |

| Proposal 4: Approval of Amended and Restated Long-Term Incentive Plan – page xx |

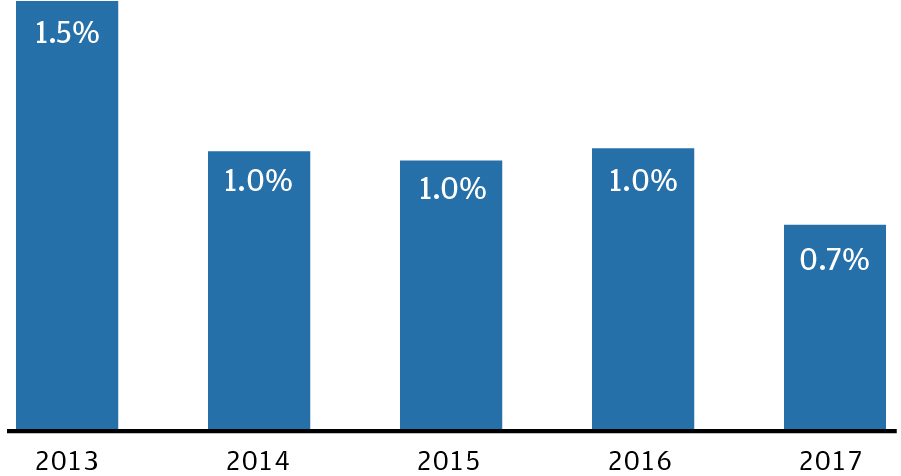

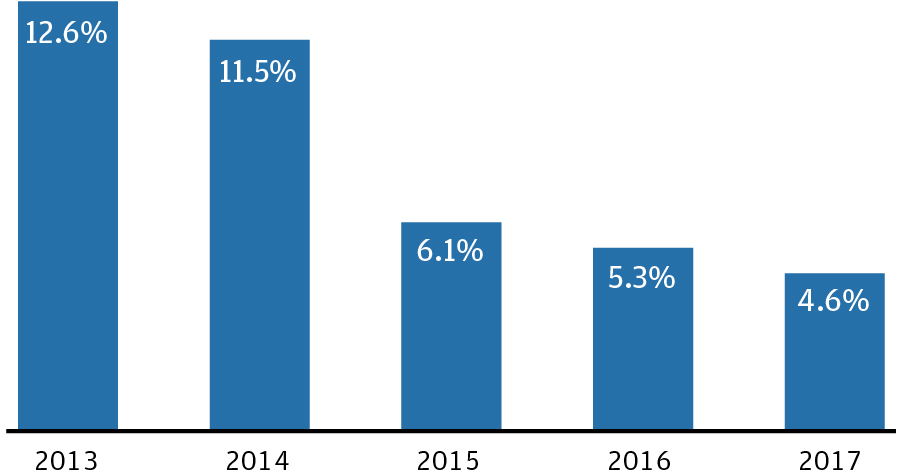

We are seeking approval of our Amended and Restated Long-Term Incentive Plan (the “2018 Plan”), to extend the term of the 2015 Plan by four years, to a term date of May 31, 2022, and to authorize approximately 24 million additional shares, bringing the total number of shares authorized under the Plan to 85 million shares (which is 10 million fewer than that approved by shareholders under the 2015 Plan). During our annual shareholder outreach program and discussion of our equity compensation practices, our shareholders indicated a preference for more frequent requests for approval of a smaller quantity of shares, as opposed to requesting larger quantities less frequently. As a result, the Compensation & Management Development Committee and the Board considered this feedback in determining the number of shares to request for authorization under the 2018 Plan.

The 2018 Plan would also incorporate our compensation program for non-employee directors, with certain established retainers (both cash and equity) and certain limitations on future changes to those retainers.

|

| | | | |

| Proposal 5: Ratification of PricewaterhouseCoopers LLP as the Firm’s independent registered public accounting firm – page xx |

The Audit Committee has appointed PricewaterhouseCoopers LLP (“PwC”) as the Firm’s independent registered public accounting firm to audit the Consolidated Financial Statements of JPMorgan Chase and its subsidiaries for the year ending December 31, 2018. A resolution is being presented to our shareholders requesting them to ratify PwC’s appointment.

|

| | |

| 7 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

Proposal 1:

Election of Directors

The Board of Directors has nominated the 12 individuals listed below; if elected at our annual meeting, they are expected to serve until next year’s annual meeting. All of the nominees are currently serving as directors. |

| | | | | | | | | | |

| The Board has nominated 12 directors: 11 independent directors and the CEO |

| | | | | | | | | | | |

| NOMINEE | | AGE | | PRINCIPAL OCCUPATION | | DIRECTOR of JPMORGAN CHASE SINCE1 | | OTHER PUBLIC COMPANY BOARDS (#) | | COMMITTEE MEMBERSHIP2 |

| Linda B. Bammann | | 61 | | Retired Deputy Head of Risk Management of JPMorgan Chase & Co.3 | | 2013 | | 0 | | Directors’ Risk Policy (Chair) |

| James A. Bell | | 68 | | Retired Executive Vice President of The Boeing Company | | 2011 | | 3 | | Audit (Chair) |

| Crandall C. Bowles | | 69 | | Chairman Emeritus of The Springs Company | | 2006 | | 1 | | Audit; Public Responsibility (Chair) |

| Stephen B. Burke | | 58 | | Chief Executive Officer of NBCUniversal, LLC | | 2004

| | 1 | | Compensation & Management Development; Corporate Governance & Nominating |

| Todd A. Combs | | 46 | | Investment Officer at Berkshire Hathaway Inc. | | 2016 | | 0 | | Directors’ Risk Policy;

Public Responsibility |

| James S. Crown | | 63 | | President of Henry Crown and Company | | 2004 | | 1 | | Directors’ Risk Policy |

| James Dimon | | 61 | | Chairman and Chief Executive Officer of JPMorgan Chase & Co. | | 2004

| | 0 | | |

| Timothy P. Flynn | | 60 | | Retired Chairman and Chief Executive Officer of KPMG | | 2012 | | 3 | | Audit; Public Responsibility |

| Laban P. Jackson, Jr. | | 74 | | Chairman and Chief Executive Officer of Clear Creek Properties, Inc. | | 2004 | | 0 | | Audit |

| Michael A. Neal | | 64 | | Retired Vice Chairman of General Electric Company and Retired Chairman and Chief Executive Officer of GE Capital | | 2014 | | 0 | | Directors’ Risk Policy |

Lee R. Raymond (Lead Independent Director) | | 78 | | Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation | | 2001 | | 0 | | Compensation & Management Development (Chair); Corporate Governance & Nominating |

| William C. Weldon | | 68 | | Retired Chairman and Chief Executive Officer of Johnson & Johnson | | 2005 | | 2 | | Compensation & Management Development; Corporate Governance & Nominating (Chair) |

| |

1

| Director of a heritage company of the Firm as follows: Bank One Corporation: Mr. Burke (2003-2004), Mr. Crown (1996-2004), Mr. Dimon, Chairman of the Board (2000-2004), and Mr. Jackson (1993-2004); First Chicago Corp.: Mr. Crown (1991-1996); and J.P. Morgan & Co. Incorporated: Mr. Raymond (1987-2000).

|

| |

2

| Principal standing committees. In March 2017, Ms. Bammann became Chair of the Directors’ Risk Policy Committee and stepped down from the Public Responsibility Committee; Mr. Bell became Chair of the Audit Committee; Mr. Combs joined the Directors’ Risk Policy Committee and the Public Responsibility Committee; and Mr. Flynn joined the Audit Committee and stepped down from the Directors’ Risk Policy Committee. |

| |

3

| Retired from JPMorgan Chase & Co. in 2005 |

|

| |

2 • JPMORGAN CHASE & CO. • 2017 PROXY STATEMENT

|

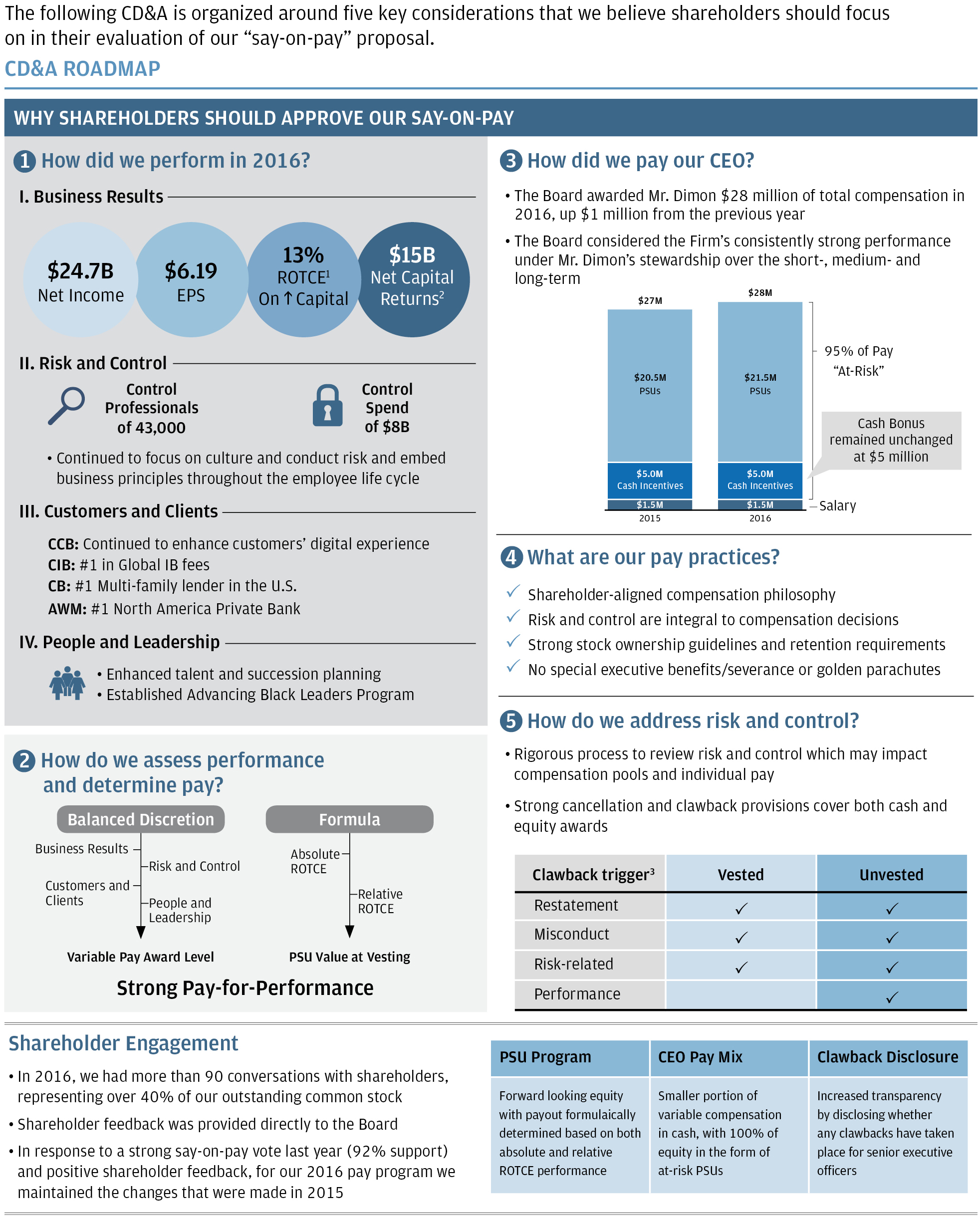

Performance, governance and compensation highlights

The following information is presented to provide a summary of 2016 Firm performance, key governance enhancements in 2016, and context for the operation of our pay program which is discussed in more detail in our Compensation Discussion and Analysis beginning on page 35 of this proxy statement. |

| | | | |

NOTABLE CHANGES SINCE 2016 ANNUAL MEETING |

| | | | |

Board Refreshment | | Board Committee Rotation | | Environmental, Social & Governance ("ESG") |

| | | | |

• Todd A. Combs elected in September 2016

• Since May 2011, five independent directors have joined the Board, each bringing a unique set of skills and experience

• Board believes refreshment of directors is integral to an effective governance structure

| | • In January 2017, Board approved changes to Audit and Risk Policy committees

• Audit: Mr. Bell became Chair and Mr. Flynn joined the committee

• Risk Policy: Ms. Bammann became Chair and Mr. Combs joined the committee

| | • We published a dedicated ESG Report last year, updating many topics from 2014’s “How We Do Business – The Report”

• Next edition expected to be published in Spring 2017

• We are committed to providing information on how we leverage our resources and capabilities to solve pressing ESG challenges

|

| | | | |

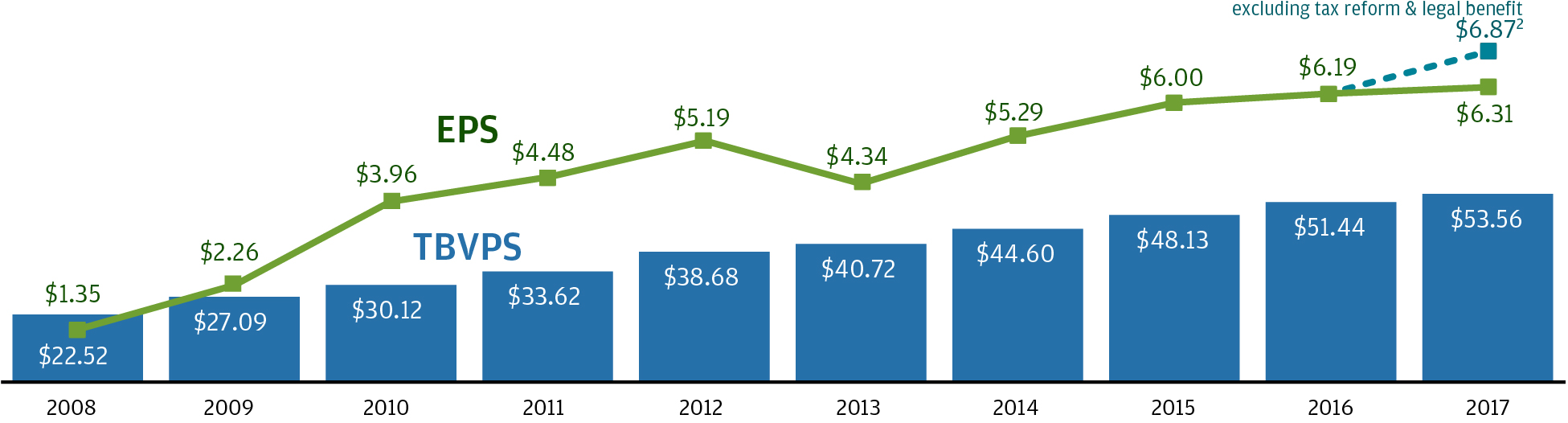

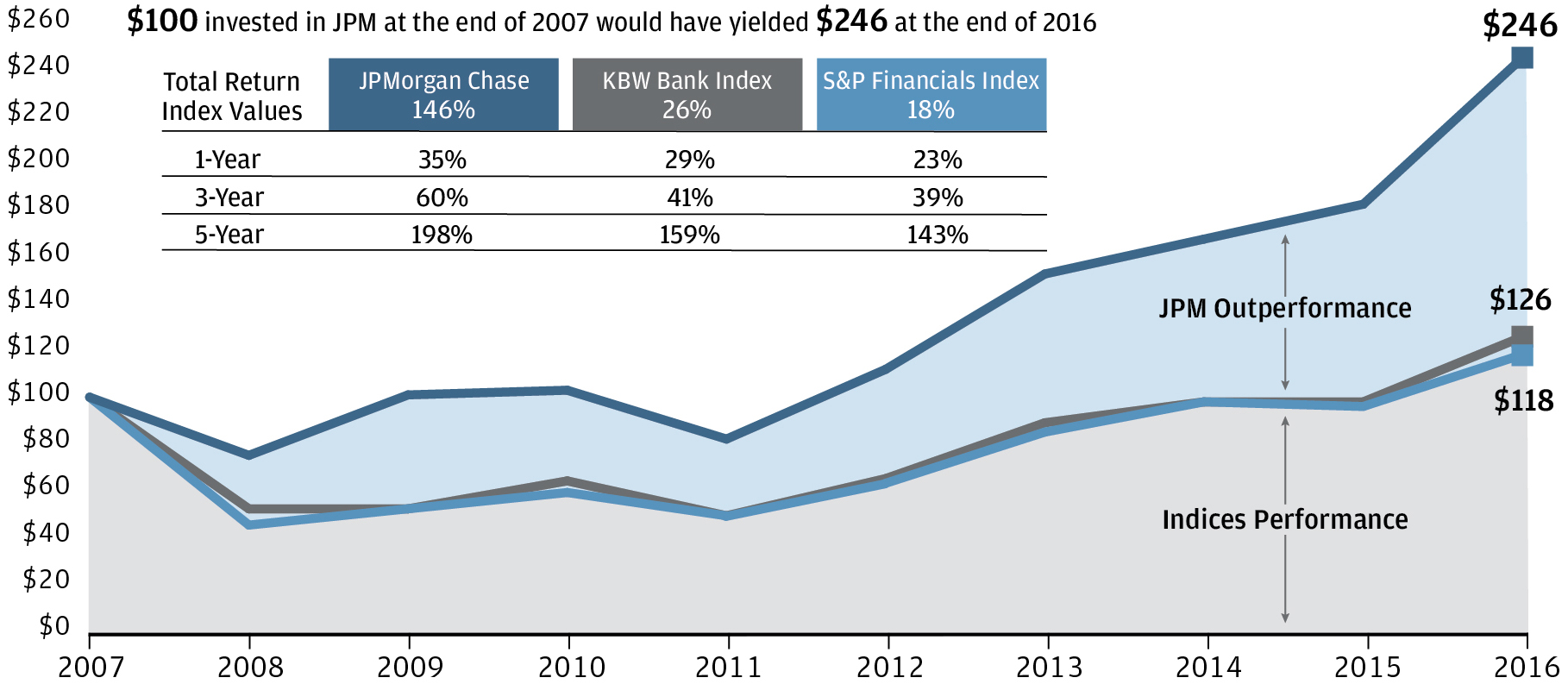

STRONG 2016 PERFORMANCE CONTINUES TO SUPPORT SUSTAINED SHAREHOLDER VALUE |

| | | | |

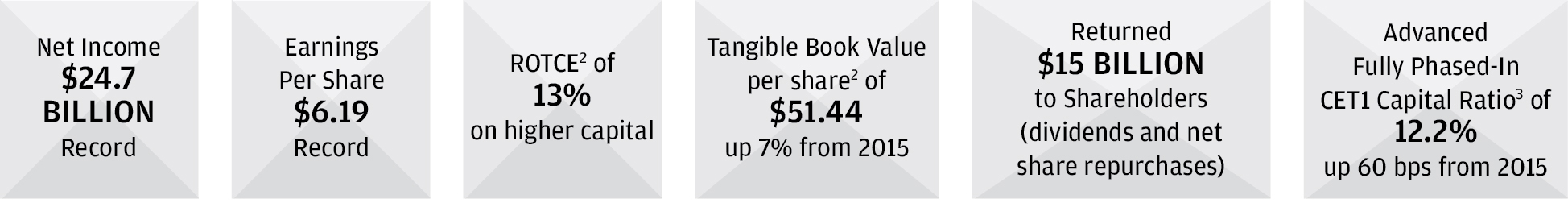

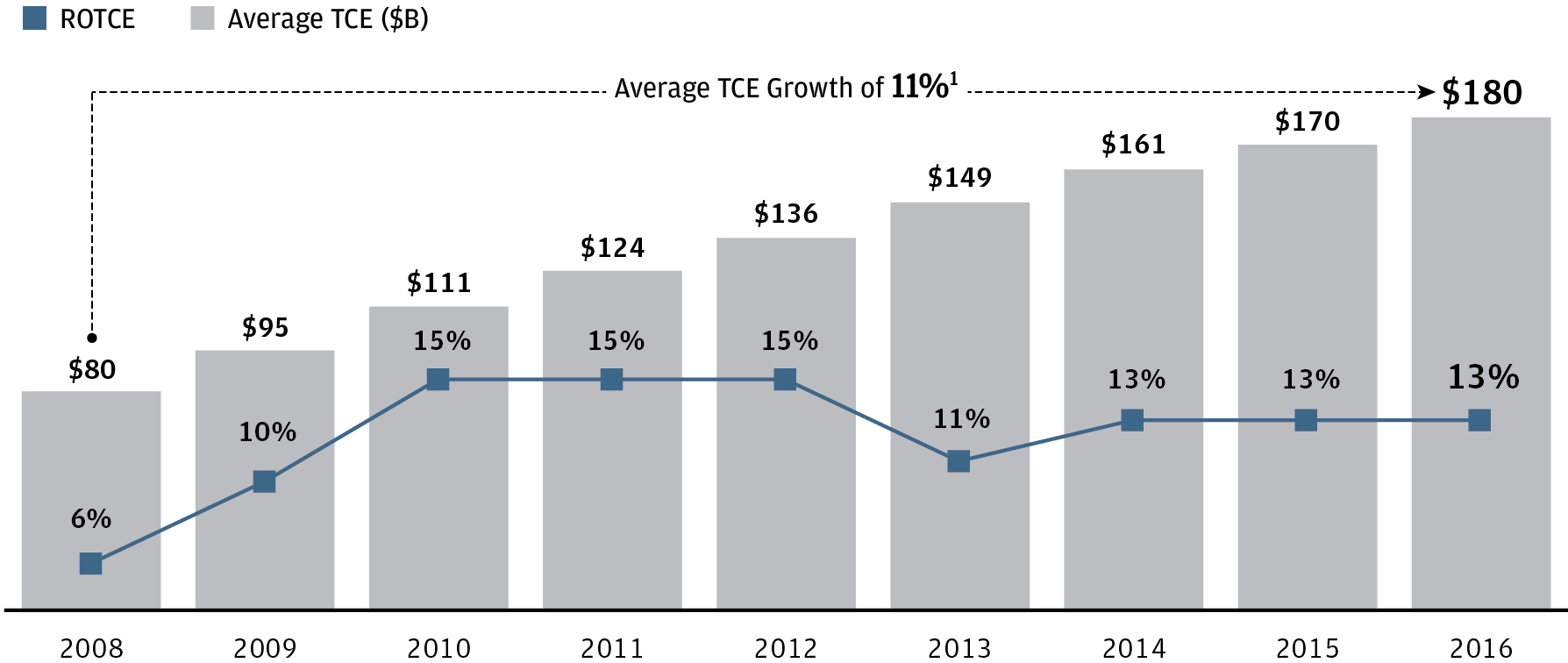

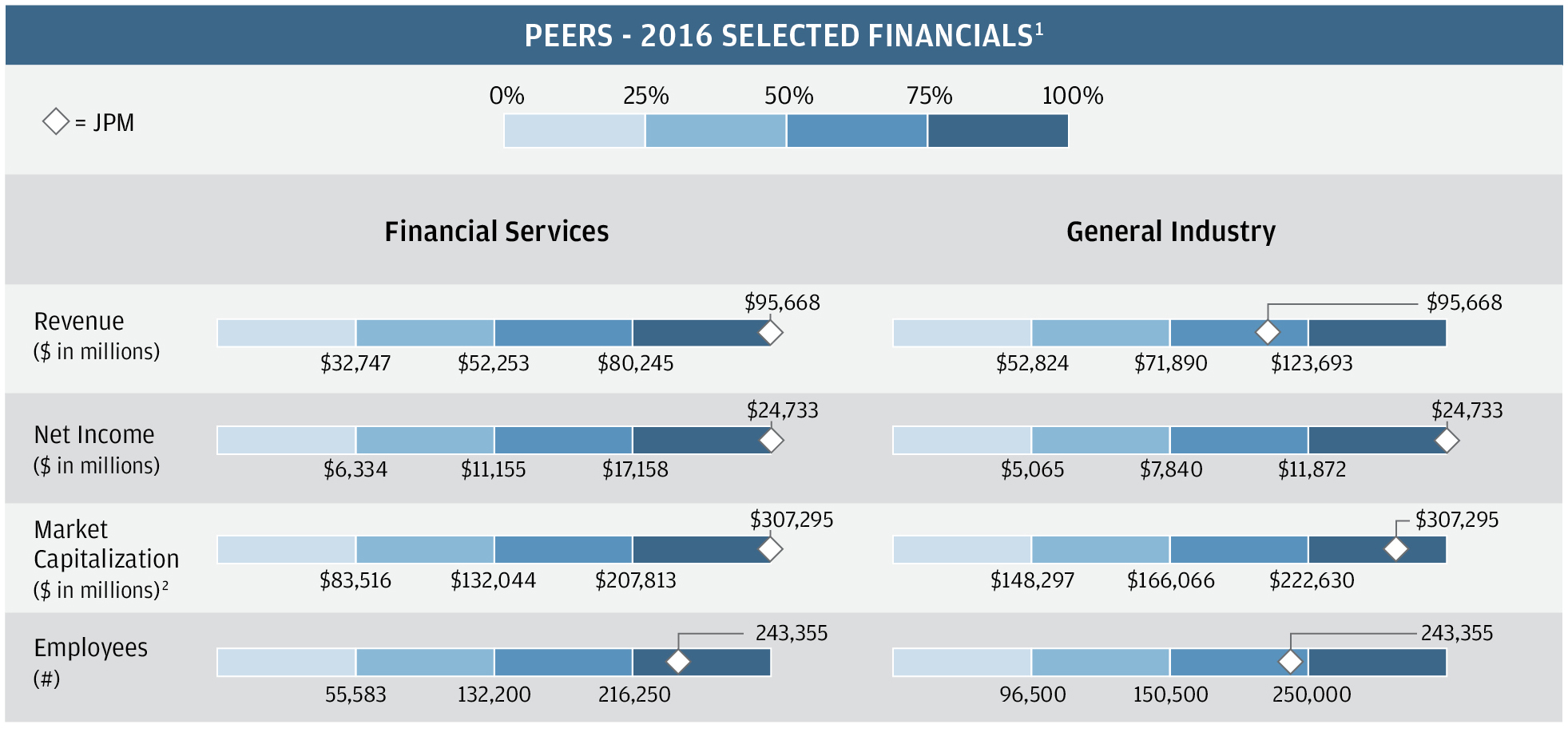

JPMorgan Chase & Co. delivered return on tangible common equity (“ROTCE”)1 of 13%, achieved record net income and record earnings per share (“EPS”), gained market share in almost all of our businesses, and continued to deliver sustained shareholder value over an extended period of time.

|

|

|

SUSTAINED SHAREHOLDER VALUE ("TSR")2

|

| |

1

| Return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”) are each non-GAAP financial measures. For a reconciliation and explanation of these non-GAAP measures, see page 102. On a comparable GAAP basis for 2016, return on equity (“ROE”) was 10% and book value per share (“BVPS”) was $64.06. |

| |

2

| Total shareholder return assumes reinvestment of dividends |

|

| |

JPMORGAN CHASE & CO. • 2017 PROXY STATEMENT • 3

|

|

| | | | | | | |

WE MAINTAIN FORTRESS OPERATING PRINCIPLES WITH FOCUS ON CAPITAL, LIQUIDITY, RISK, CONTROLS AND CULTURE |

| | | | | | | |

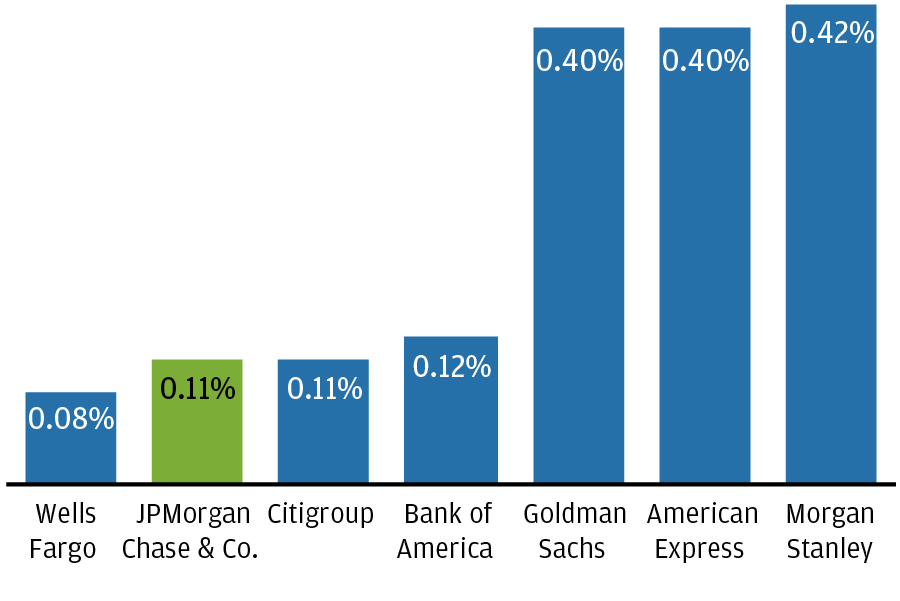

• We maintained our fortress balance sheet, growing our Basel III Advanced Fully Phased-In common equity Tier 1 (“CET1”) capital ratio1 by 60 bps to 12.2% and maintaining $524 billion of high quality liquid assets.

• We continued to strengthen and reinforce our culture and business principles. The culture and conduct program is a key priority for every line of business and function.

• We have embedded our business principles throughout the employee life cycle, starting with the recruiting and onboarding process and extending to training, compensation, promoting and disciplining employees.

• We have invested significantly in our control environment including a control headcount of 43,000 professionals with a control spend of approximately $8 billion.

|

| | | | | | | |

WE ARE COMMITTED TO GOOD CORPORATE GOVERNANCE AND ARE ENGAGED WITH OUR SHAREHOLDERS |

| | | | | | | |

The Board maintains a robust Lead Independent Director role and is committed to sound and commonsense governance principles.

Our Board has endorsed the Shareholder Director Exchange (SDX) Protocol as a guide for engagement.

| | RECENT UPDATES |

| |

| GOVERNANCE |

| | | | | | |

| | Our engagement process, and the feedback gained from it, was a significant factor in the Board’s continued effort to appoint new directors as well as rotate directors across key committees. |

| | | | | | |

| COMPENSATION |

|

|

| | | | | | | |

In 2016, our shareholder engagement initiatives included:

ŸShareholder Outreach: More than 90 discussions on strategy, financial performance, governance, compensation, and environmental & social issues with shareholders representing over 40% of our shares

ŸAnnual Investor Day: Senior management gave presentations at our annual Investor Day on strategy and financial performance

ŸMeetings/Conferences: Senior management hosted more than 60 investor meetings and presented at 12 investor conferences

ŸAnnual Meeting: Our CEO and Lead Independent Director presented to shareholders at the Firm’s annual meeting

| | | In response to a strong say-on-pay vote last year (92% support) and positive shareholder feedback, for our 2016 pay program we maintained the changes that were made in 2015, including: |

| | PSU Program | | CEO Pay Mix | | Clawback Policy |

| | | | | | |

| | Forward looking equity with payout formulaically determined based on both absolute and relative ROTCE performance | | Smaller portion of variable compensation in cash, with 100% of equity in the form of

at-risk PSUs

| | Increased transparency by disclosing whether any clawbacks have taken place for senior executive officers |

| | | | | | |

| | In addition to the above, other aspects of our pay program continue to be aligned with the interest of shareholders, including:

• Holistic assessment of performance in determining variable pay award levels while using a formula to determine PSU value at vesting

• Strong stock ownership guidelines and retention requirements

• No special executive benefits/severance or golden parachutes

• Rigorous process to review risk and control which may impact compensation pools and individual pay

• Strong cancellation and clawback provisions cover both cash and equity awards

|

|

| |

| |

1

| The CET1 capital ratio under the Basel III Fully Phased-In capital rules is considered a key regulatory capital measure. For more information, see Notes on key performance measures on page 102. |

|

| |

4 • JPMORGAN CHASE & CO. • 2017 PROXY STATEMENT

|

|

|

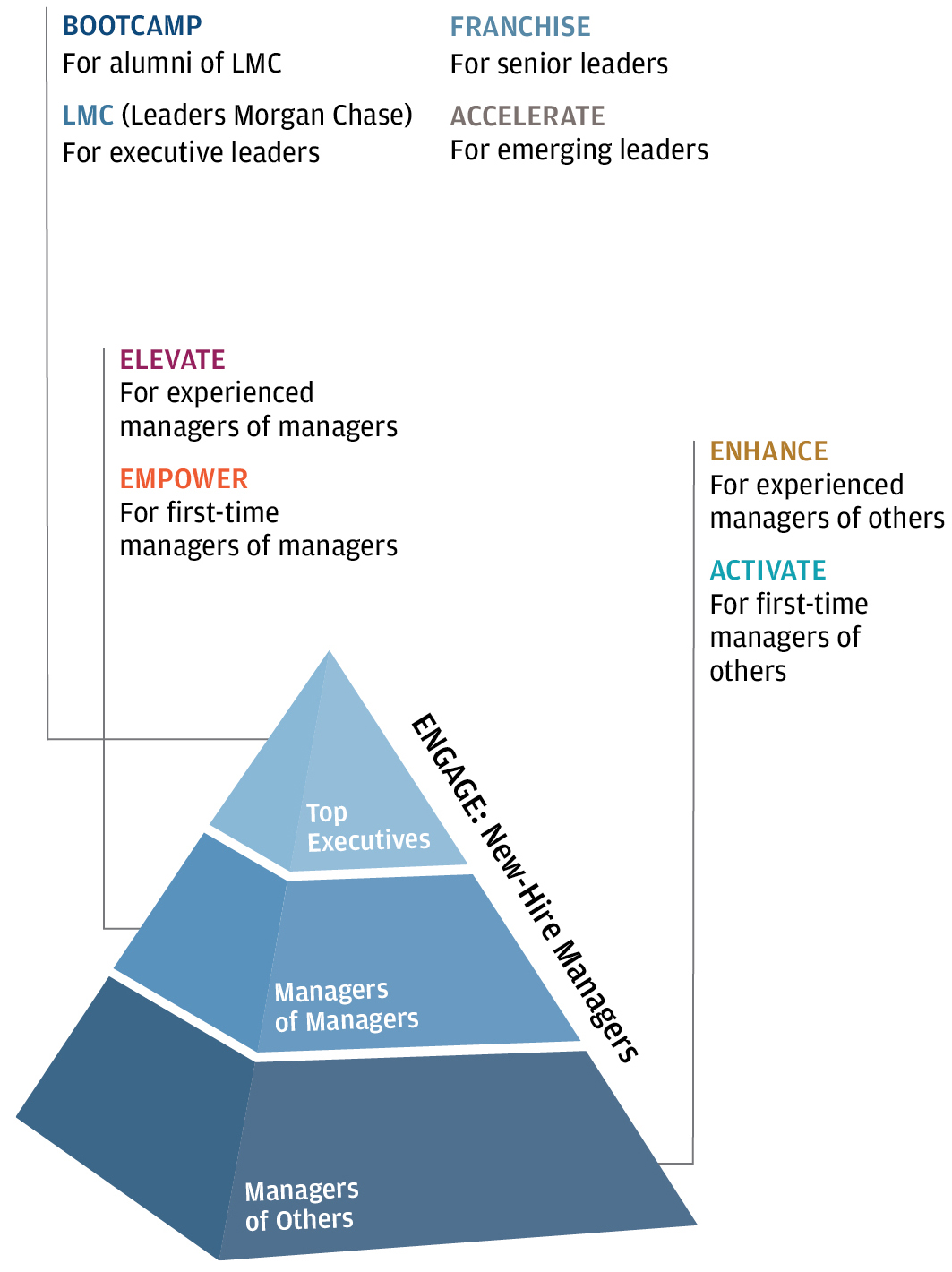

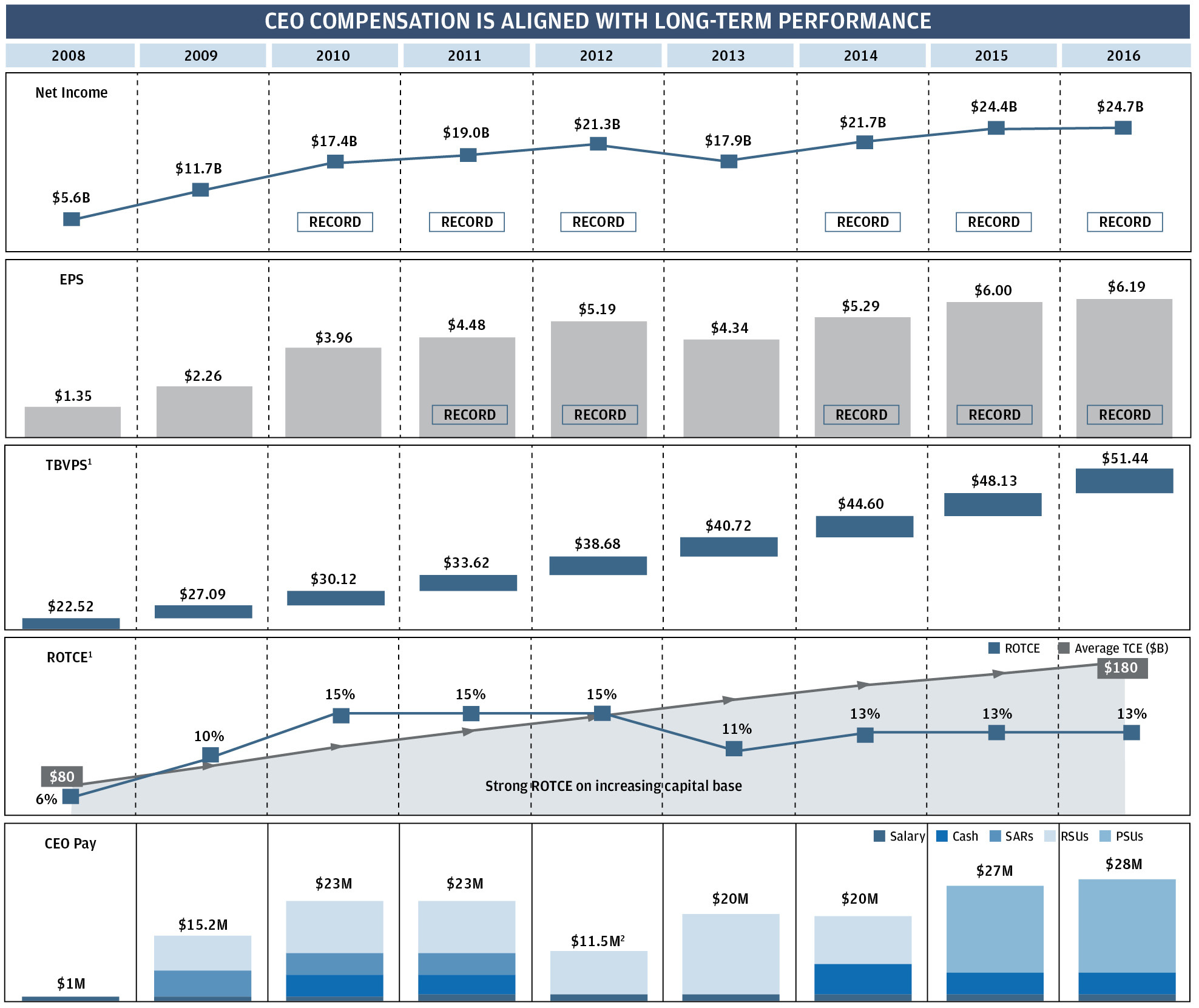

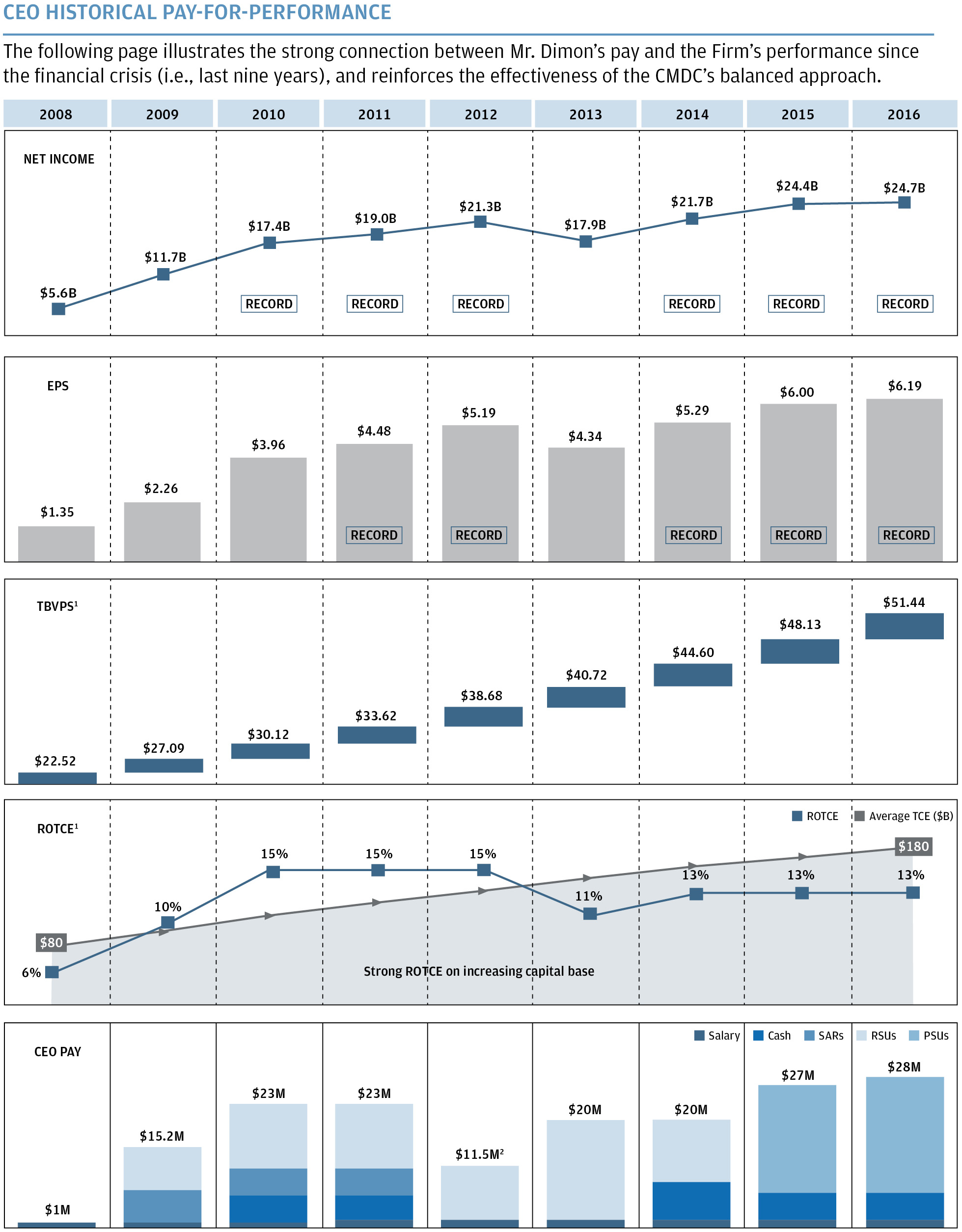

MR. DIMON’S 2016 COMPENSATION IS ALIGNED WITH HIS MULTI-YEAR PERFORMANCE |

|

In assessing Mr. Dimon's performance, the Board considered his achievements holistically against business results, risk and control, customers and clients, and people and leadership. The Board took into account Mr. Dimon's performance in leading the Firm over a sustained period of time, including strong performance in 2016.

| |

I. | Business results: During 2016, the Firm again achieved record net income and record EPS, while generating strong ROTCE results of 13%1 on average tangible common equity of $180 billion1 (vs. $170 billion in 2015).

|

| |

II. | Risk and Control: The Board also recognized that Mr. Dimon deployed substantial resources to fortify our control environment, which has led to a control infrastructure that better permeates across and deeply within our businesses. Mr. Dimon has fostered a culture that seeks continuous improvement and regards the risk and control agenda as a top priority, which reflects the Firm's ability to successfully adapt to an evolving regulatory landscape.

|

| |

III. | Customers and Clients: Mr. Dimon has guided the Firm’s focus on creating and enhancing services that add value to our customers and clients through product innovation, cutting edge technologies, and simplified processes.

|

| |

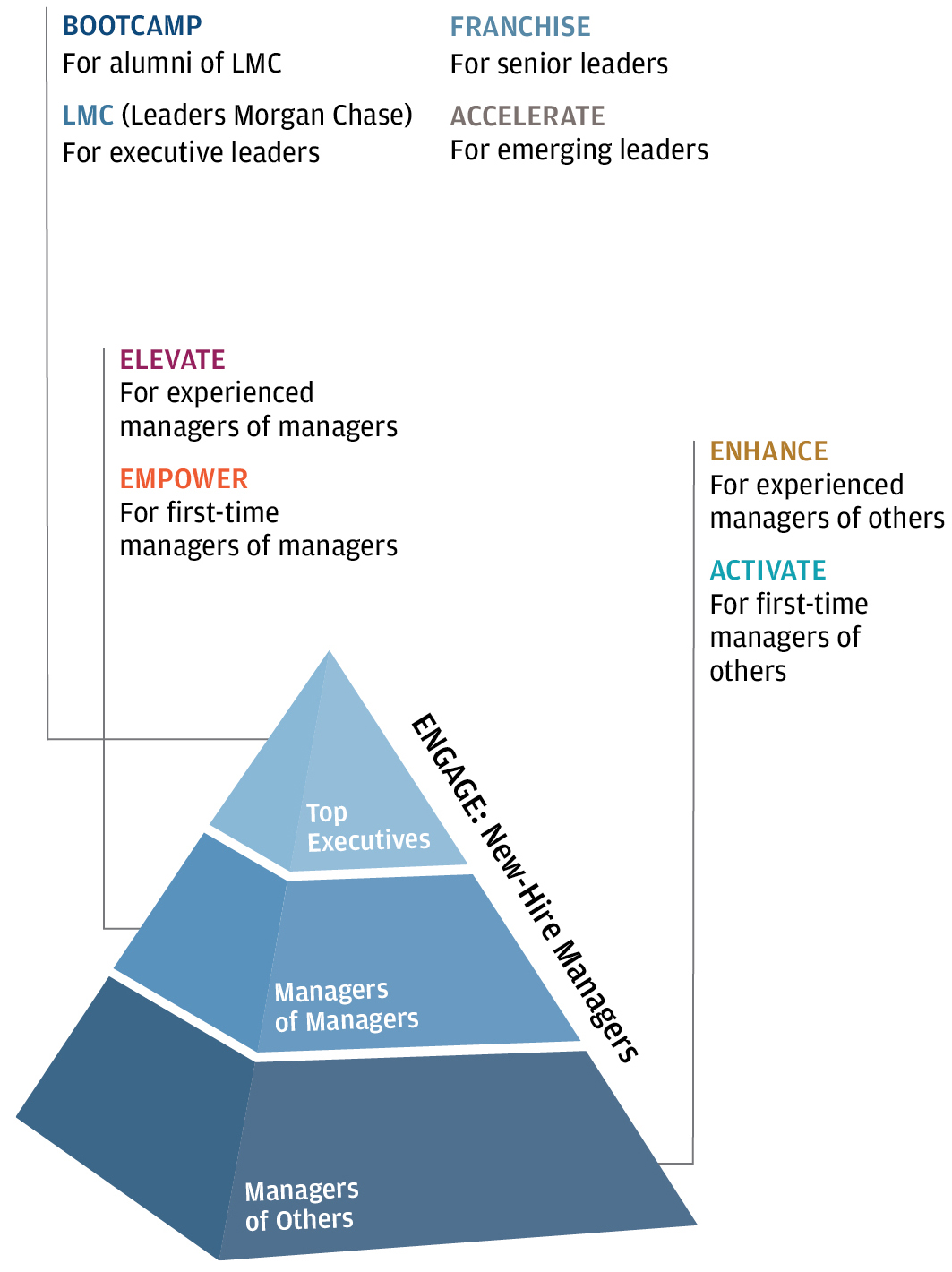

IV. | People and Leadership: Mr. Dimon’s stewardship over the Firm’s People and Leadership agenda, has led to a highly effective management development program (Leadership Edge), a robust pipeline of leaders across the organization and a diversity strategy that attracts, motivates, and retains some of the best possible talent.

|

Based on Mr. Dimon's performance, the Board increased his annual compensation to $28 million (from $27 million in 2015). The Board also considered several other factors, some of which are set forth on pages 47–49.

| |

1

| TBVPS and ROTCE are each non-GAAP financial measures. For a reconciliation and explanation of these non-GAAP measures, see page 102. On a comparable U.S. GAAP basis, for 2008 through 2016 respectively, return on equity (“ROE”) was 4%, 6%, 10%, 11%, 11%, 9%, 10%, 11%, and 10%, and book value per share (“BVPS”) was $36.15, $39.88, $42.98, $46.52, $51.19, $53.17, $56.98, $60.46, and $64.06. |

| |

2

| Despite record net income and 15% ROTCE, the Board exercised discretion relating to risk and control and reduced Mr. Dimon’s pay in 2012. |

|

| |

JPMORGAN CHASE & CO. • 2017 PROXY STATEMENT • 5

|

This page intentionally left blank

|

| |

6 • JPMORGAN CHASE & CO. • 2017 PROXY STATEMENT

|

Proposal 1:

Election of Directors

Our Board of Directors has nominated 12 directors, who, if elected by shareholders at our annual meeting, will be expected to serve until next year’s annual meeting. All nominees are currently directors.

|

| |

| ü | RECOMMENDATION: Vote FOR all nominees |

Proposal 2:

Ratification of special meeting provisions in the Firm’s By-Laws

The Board is seeking shareholder ratification of the provisions of the Firm’s By-Laws, as amended, that grant shareholders who own at least 20% of the Firm’s outstanding common stock and satisfy other requirements, the ability to direct the Firm to call a special meeting of shareholders.

|

| |

| ü | RECOMMENDATION: Vote FOR ratification of special meeting provisions |

|

| | |

JPMORGAN CHASE & CO. • 20172018 PROXY STATEMENT• 7 | | 8 |

Proposal 1 — Election of directors

Our Board has nominated 12 directors for election at this year’s annual meeting. Our Board believes these nominees afford our Firm the combined skills, experience, and personal qualities, as well as the length of tenure and collegial tone, needed for an effective and engaged Board.

Information about:

| |

| ▪ | The specific experience and qualifications of each of our nominees are described at pages xx-xx |

| |

| ▪ | The personal and professional attributes and skills of our nominees are described at pages xx-xx |

Our commitment to sound governance is integral to our business. The Firm’s Corporate Governance Principles (“Principles”) establish a framework for the governance of the Board and the management of the Firm. These Principles outline the Firm’s practices regarding Board composition, responsibilities and obligations, structure, and operations, among other governance matters. The Principles have been approved by the Board and are periodically reviewed and updated as appropriate. They reflect broadly recognized governance practices and regulatory requirements including New York Stock Exchange (NYSE) corporate governance listing standards. The full text of the Corporate Governance Principles can be accessed on our website at jpmorganchase.com/corp-gov-principles.

Descriptions of our governance practices related to:

| |

| ▪ | Board composition, nomination and succession planning can be found at pages xx-xx |

| |

| ▪ | How our Board conducts its business can be found at pages xx-xx |

| |

| ▪ | Board oversight of the business and affairs of the Firm can be found at pages xx-xx |

| |

| ▪ | The active engagement of our directors with the Firm’s stakeholders can be found at pages xx-xx |

| |

| ▪ | Other corporate governance policies and practices can be found at pages xx-xx |

| |

| ▪ | Director compensation can be found at page xx |

The Board regularly reviews its governance principles and best practices. As part of these reviews, the Board seeks to ensure that the views and input of shareholders are understood and represented. Currently, the Firm’s By-Laws grant shareholders who own at least 20% of the Firm’s shares the right to call a special meeting. During our shareholder engagement program, most shareholders expressed support for the right of shareholders to call a special meeting if an appropriate threshold of holders request it. However, there were varying opinions regarding what that appropriate threshold should be. Accordingly, and in lieu of a shareholder proposal seeking to hold office untilreduce the next annualthreshold, the Board is seeking shareholder ratification of the special meeting provisions in the Firm's By-Laws which include a threshold providing that holders of at least 20% of the outstanding shares have the right to call a special meeting. Further information about this management proposal is described at pages xx-xx.

|

| | |

| 9 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

Proposal 1 — Election of directors

Director nominees

The persons listed on the following pages have been nominated for election because they possess the skills, experience, and personal attributes needed to guide the Firm’s strategy, and to oversee its risk management framework and management’s execution of its responsibilities.

In the biographical information about our director nominees which follows, the ages indicated are as of May 15, 2018, and the other information is as of the date of this proxy statement. There are no family relationships among the director nominees. Unless otherwise stated, all nominees have been continuously employed by their present employers for more than five years.

In addition to the biographical information which follows, reference is made to the description of our nominees’ personal and professional attributes and skills at page xx of this proxy statement.

All of the nominees are currently directors and 11 wereof the Firm. Other than Ms. Hobson, who was elected to the Board

in March 2018, each was elected to the Board by our shareholders at our 20162017 annual meeting, each with the support of more than 96%95% of the votes cast. In September 2016,For more information about the Board elected Todd A. Combs to a term expiring at the 2017 annual meeting. For an overviewrecruitment of each of our nominees,Ms. Hobson, see page 2xx of this proxy statement.

EachMs. Bowles, who has served as a director of the 12 nomineesFirm since 2006, has decided to retire from the Board and is not standing for re-election when her term expires on the eve of this year’s annual meeting.

Each nominee has agreed to be named in this proxy statement and, if elected, to serve if elected.a one-year term expiring at our 2019 annual meeting.

Directors are expected to attend our annual shareholder meetings. All of the then current nominees were present at the annual meeting held in May 2017. All of the current nominees are expected to attend our 20172018 annual meeting. If anyshareholder meeting, other than Mr. Bell, who is unable to attend due to a prior professional obligation.

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 10 |

|

| | | | |

| | | Linda B. Bammann Retired Deputy Head of Risk Management of JPMorgan Chase & Co. |

Age:62 | | | Through her service on other boards, including as Chair of the Business and Risk Committee of the Federal Home Loan Mortgage Corporation, and her management tenure at JPMorgan Chase and Bank One Corporation, Ms. Bammann has developed insight and wide-ranging experience in financial services and extensive experience in risk management and regulatory issues. |

| | |

Director since:2013 Committees: Directors' Risk Policy Committee (Chair) Director Qualification Highlights: Financial services Regulated industries and regulatory issues Risk management and controls

| | |

| | | |

| | Career Highlights JPMorgan Chase & Co., a financial services company (merged with Bank One Corporation in July 2004) ▪ Deputy Head of Risk Management (2004– 2005)▪ Chief Risk Management Officer and Executive Vice President, Bank One Corporation (2001–2004)▪ Senior Managing Director, Banc One Capital Markets (2000–2001) | Other Public Company Directorships ▪ Federal Home Loan Mortgage Corporation (2008–2013)▪ Manulife Financial Corporation (2009–2012)Other Experience ▪ Former Board Member, Risk Management Association▪ Former Chair, Loan Syndications and Trading AssociationEducation ▪ Graduate of Stanford University▪ M.A., Public Policy, University of Michigan |

|

| | | | |

| | | James A. Bell Retired Executive Vice President of The Boeing Company |

Age:69 | | | Over a four-decade corporate career, Mr. Bell led global businesses in a highly regulated industry, oversaw successful strategic growth initiatives, and developed extensive experience in finance, accounting, risk management and controls. While Chief Financial Officer, he oversaw two key Boeing businesses: Boeing Capital Corporation, the company’s customer-financing subsidiary, and Boeing Shared Services, an 8,000 person, multi-billion dollar business unit that provides common internal services across Boeing’s global enterprise. |

| | |

Director since:2011 Committees: Audit Committee (Chair) Director Qualification Highlights: Financial and accounting Leadership of a large, complex organization Regulatory industries and regulatory issues Technology

| | |

| | | |

| | Career Highlights The Boeing Company, an aerospace company and manufacturer of commercial jetliners and military aircraft ▪ Corporate President (2008–2012)▪ Executive Vice President (2003–2012)▪ Chief Financial Officer (2003–2012)▪ Senior Vice President of Finance and Corporate Controller (2000–2003) | Other Public Company Directorships ▪ CDW Corporation (since 2005)▪ Dow DuPont Inc. (formerly Dow Chemical Company Inc.) (since 2005)Other Experience ▪ Trustee, Rush University Medical CenterEducation ▪ Graduate of California State University at Los Angeles |

| |

| |

|

| | |

| 11 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

|

| | | | |

| | | Stephen B. Burke Chief Executive Officer of NBCUniversal, LLC |

Age:59 | | | Mr. Burke’s roles at Comcast Corporation and his prior work at other large global media corporations have given him broad exposure to the challenges associated with managing large and diverse businesses. In these roles he has dealt with a variety of issues including audit and financial reporting, risk management, executive compensation, sales and marketing, technology, and operations. These experiences have also provided Mr. Burke a background in regulated industries and international business. |

| | |

Director since:2004 and Director of Bank One Corporation from 2003 to 2004 Committees: Compensation & Management Development Committee Corporate Governance & Nominating Committee Director Qualification Highlights: Financial and accounting Leadership of a large, complex organization Management development and succession planning Regulated industries and regulatory issues

| | |

| | | |

| | Career Highlights Comcast Corporation/NBCUniversal, LLC, leading providers of entertainment, information and communication products and services ▪ Chief Executive Officer of NBCUniversal, LLC, and a senior executive of Comcast (since 2011)▪ Chief Operating Officer, Comcast (2004– 2011)▪ President, Comcast Cable Communications Inc. (1998–2010)

| Other Public Company Directorships ▪ Berkshire Hathaway Inc. (since 2009)Education ▪ Graduate of Colgate University▪ M.B.A., Harvard Business School |

| |

| |

|

| | | | |

| | | Todd A. Combs Investment Officer at Berkshire Hathaway Inc. |

Age:47 | | | Mr. Combs’ roles have provided him with extensive experience in financial markets, risk assessment, and regulatory matters. His service on three of Berkshire Hathaway’s subsidiary boards has given him insights into matters such as corporate governance, strategy, succession planning, and compensation. |

| | |

Director since:2016 Committees: Directors’ Risk Policy Committee Public Responsibility Committee Director Qualification Highlights: Financial services Regulated industries and regulatory issues Risk management and controls

| | |

| | | |

| | Career Highlights Berkshire Hathaway Inc., a holding company whose subsidiaries engage in a number of diverse business activities including finance, insurance and reinsurance, utilities and energy, freight rail transportation, manufacturing, retailing, and other services ▪ Investment Officer (since 2010)Castle Point Capital Management, an investment partnership Mr. Combs founded in 2005 to manage capital for endowments, family foundations, and institutions ▪ CEO and Managing Member (2005–2010) | Other Public Company Directorships Education ▪ Graduate of Florida State University▪ M.B.A., Columbia Business School |

| |

| |

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 12 |

The Board is responsible for overseeing management and promoting sound corporate governance on behalf

|

| | | | |

| | | James S. Crown President of Henry Crown and Company |

Age:64 | | | Mr. Crown’s position with Henry Crown and Company and his service on other public company boards have given him extensive experience with risk management, audit and financial reporting, investment management, capital markets activity, and executive compensation matters. |

| | |

Director since:2004 and Director of Bank One Corporation from 1991 to 2004 Committees: Directors’ Risk Policy Committee Director Qualification Highlights: Financial services Management development and succession planning Risk management and controls

| | |

| | | |

| | Career Highlights Henry Crown and Company, a privately owned investment company that invests in public and private securities, real estate, and operating companies ▪ Vice President (1985–2002) | Other Public Company Directorships ▪ General Dynamics (since 1987) - Lead Director since 2010▪ Sara Lee Corporation (1998-2012)Other Experience ▪ Chairman of the Board of Trustees, Aspen Institute▪ Trustee, Museum of Science and Industry▪ Trustee, University of Chicago▪ Member, American Academy of Arts and Sciences▪ Former member of the President’s Intelligence Advisory BoardEducation ▪ Graduate of Hampshire College▪ JD, Stanford University Law School |

| |

| |

|

| | | | |

| | | James Dimon Chairman and Chief Executive Officer of JPMorgan Chase & Co. |

Age:62 | | | Mr. Dimon is an experienced leader in the financial services industry, and has extensive international business experience as well. As CEO, he is knowledgeable about all aspects of the Firm’s business activities. His work has given him substantial experience and insight into the regulatory process. |

| | |

Director since:2004 and Chairman of the Board of Bank One Corporation from 2000 to 2004 Director Qualification Highlights: Financial services Leadership of a large, complex organization Management development and succession planning Regulated industries and regulatory issues

| | |

| | | |

| | Career Highlights JPMorgan Chase & Co., a financial services company (merged with Bank One Corporation in July 2004) ▪ Chairman of the Board (since 2006) and Director (since 2004); Chief Executive Officer (since 2005)▪ Chief Operating Officer (2004–2005)▪ Chairman and Chief Executive Officer at Bank One Corporation (2000–2004) | Other Public Company Directorships Other Experience ▪ Director, Harvard Business School▪ Chairman, Business Roundtable▪ Member, Business Council▪ Trustee, New York University School of MedicineEducation ▪ Graduate of Tufts University▪ M.B.A., Harvard Business School |

| |

| |

|

| | |

| 13 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

|

| | | | |

| | | Timothy P. Flynn Retired Chairman and Chief Executive Officer of KPMG |

Age:61 | | | Through his leadership positions at KPMG, Mr. Flynn gained perspective on the evolving business and regulatory environment, experience with many of the issues facing complex, global companies, and extensive experience in financial services, auditing matters and risk management. |

| | |

Director since:2012 Committees: Audit Committee Public Responsibility Committee Director Qualification Highlights: Financial services Financial and accounting Leadership of a large, complex organization Risk Management and controls

| | |

| | | |

| | Career Highlights KPMG International, a global professional services organization providing audit, tax and advisory services ▪ Chairman, KPMG International (2007– 2011)▪ Chairman, KPMG LLP (2005–2010)▪ Chief Executive Officer, KPMG LLP (2005– 2008)▪ Vice Chairman, Audit and Risk Advisory Services, KPMG LLP (2001–2005) | Other Public Company Directorships ▪ United Healthcare (since 2017)▪ Alcoa Corporation (since 2016)▪ Wal-Mart Stores, Inc. (since 2012)▪ Chubb Corporation (2013–2016)Other Experience ▪ Member, Board of Trustees, The University of St. Thomas▪ Former Trustee, Financial Accounting Standards Board▪ Former Member, World Economic Forum’s International Business Council▪ Former Board Member, International Integrated Reporting CouncilEducation ▪ Graduate of The University of St. Thomas |

| |

| |

|

| | | | |

| | | Mellody Hobson President of Ariel Investments, LLC |

Age:49 | | | Ms. Hobson’s roles at Ariel Investments, LLC and on other public company boards have provided her with significant experience in financial services and financial markets, corporate governance, strategic planning, operations, regulatory issues, and international business. |

| | |

Director since:March2018 Committees:Ms. Hobson will begin her committee service after the 2018 annual meeting Director Qualification Highlights: Financial services Management development and succession planning Regulated industries and regulatory issues | | |

| | | |

| | Career Highlights Ariel Investments, LLC, a Chicago-based investment management firm ▪ Chairman of the Board of Trustees of Ariel Investment Trust, a registered investment company (since 2006)▪ Regular contributor and analyst on finance, the markets, and economic trends for CBS News | Other Public Company Directorships ▪ The EstéeLauder Companies Inc. (since 2005)▪ Starbucks Corporation (since 2005)Other Experience ▪ Chairman, After School Matters▪ Director, Economic Club of Chicago▪ Board member, The Chicago Public Education Fund▪ Executive Committee of the Investment Company Institute’s Board of GovernorsEducation ▪ Graduate of the Woodrow Wilson School of International Relations and Public Policy at Princeton University |

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 14 |

|

| | | | |

| | | Laban P. Jackson, Jr. Chairman and Chief Executive Officer of Clear Creek Properties, Inc. |

Age:75 | | | Mr. Jackson’s service on the board of the Federal Reserve Bank of Cleveland and on other public and private company boards has given him extensive experience in financial services, risk management, audit and financial reporting matters, government relations and regulatory issues, and executive compensation and succession planning matters. |

| | |

Director since:2004 and Director of Bank One Corporation from 1993 to 2004 Committees: Audit Committee Director Qualification Highlights: Financial and accounting Management development and succession planning Regulated industries and regulatory issues Risk management and controls | | |

| | | |

| | Career Highlights Clear Creek Properties, Inc., a real estate development company ▪ Chairman and Chief Executive Officer (since 1989) | Other Public Company Directorships ▪ The Home Depot (2004–2008)Other Experience ▪ Former Director, Federal Reserve Bank of Cleveland▪ Emeritus Trustee, Markey Cancer FoundationEducation ▪ Graduate of the United States Military Academy |

| |

| |

|

| | | | |

| | | Michael A. Neal Retired Vice Chairman of General Electric Company and Retired Chairman and Chief Executive Officer of GE Capital |

Age:65 | | | Mr. Neal has extensive experience managing large, complex businesses in regulated industries around the world. During his career with General Electric and GE Capital, Mr. Neal oversaw the provision of financial services and products to consumers and businesses of all sizes globally. His professional experience has provided him with insight and extensive expertise in risk management, strategic planning and operations, finance and financial reporting, government and regulatory relations, and management development and succession planning. |

| | |

Director since:2014 Committees: Directors’ Risk Policy Committee Director Qualification Highlights: Financial services Leadership of large, complex organization International business operations Technology

| | |

| | | |

| | Career Highlights General Electric Company, a global industrial and financial services company ▪ Vice Chairman (2005–2013)▪ Chairman and Chief Executive Officer, GE Capital (2007–2013) | Other Public Company Directorships Other Experience ▪ Founder and advisor, Acasta Enterprises, Inc.▪ Member, Advisory Board, Sam Nunn School of International Affairs, Georgia Institute of Technology▪ Trustee, The GT Foundation of the Georgia Institute of TechnologyEducation ▪ Graduate of the Georgia Institute of Technology |

| |

| |

|

| | |

| 15 | | JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT

|

|

| | | | |

| | | Lee R. Raymond (Lead Independent Director) Retired Chairman and Chief Executive Officer of Exxon Mobil Corporation |

Age:79 | | | During his tenure at ExxonMobil and its predecessors, Mr. Raymond gained experience in all aspects of business management, including audit and financial reporting, risk management, executive compensation, marketing, and operating in a regulated industry. He also has extensive international business experience. |

| | |

Director since: 2001 and Director of J.P. Morgan & Co. Incorporated from 1987 to 2000 Committees: Compensation & Management Development Committee (Chair) Corporate Governance & Nominating Committee Director Qualification Highlights: International business operations Management development and succession planning Public company governance Technology | | |

| | | |

| | Career Highlights ExxonMobil, an international oil and gas company ▪ Chairman and Chief Executive Officer of ExxonMobil (1999–2005)▪ Chairman and Chief Executive Officer of Exxon Corporation (1993–1999) | Other Public Company Directorships Other Experience ▪ Member, Council on Foreign Relations▪ Emeritus Trustee, Mayo Clinic▪ Member, National Academy of Engineering▪ Member and past Chairman of the National Petroleum CouncilEducation ▪ Graduate of the University of Wisconsin▪ PhD., Chemical Engineering, University of Minnesota

|

| |

| |

|

| | | | |

| | | William C. Weldon Retired Chairman and Chief Executive Officer of Johnson & Johnson |

Age:69 | | | At Johnson & Johnson, Mr. Weldon held a succession of executive positions that gave him extensive experience in consumer sales and marketing, international business operations, financial reporting and regulatory matters. |

| | |

Director since:2005 Committees: Corporate Governance & Nominating Committee (Chair) Compensation & Management Development Committee Director Qualification Highlights: International business operations Leadership of a large, complex organization Management development and succession planning Public company governance | | |

| | | |

| | Career Highlights Johnson & Johnson, a global healthcare products company ▪ Chairman of the Board and Chief Executive Officer (2002–2012)▪ Vice Chairman, Pharmaceuticals Group (2001–2002) | Other Public Company Directorships ▪ CVS Health Corporation (since 2013)▪ Exxon Mobil Corporation (since 2013)▪ The Chubb Corporation (2013–2016)▪ Johnson & Johnson (2002–2012)Other Experience ▪ Chairman, Board of Trustees, Quinnipiac UniversityEducation ▪ Graduate of Quinnipiac University |

| |

| |

|

| | |

JPMORGAN CHASE & CO. • 2018 PROXY STATEMENT | | 16 |

|

|

DIRECTOR NOMINATION PROCESSBoard composition, nomination and succession process |

| |

As specified in its charter,JPMorgan Chase seeks director candidates who will uphold the Board’s Corporate Governance & Nominating Committee (“Governance Committee”) oversees the candidate nomination process, which includes the continual evaluation of new candidates for Board membership, and recommendshighest standards, are committed to the Board a slateFirm’s values, and who will be strong independent stewards of nominees for election at each annual meetingthe long-term interests of shareholders. The Governance Committee considers all relevant attributes of each Board candidate, including professional skills,also looks for individuals with demonstrated experience and knowledge,success in executive fields relevant to

the Firm’s businesses and gender, race, ethnicity, nationalityoperations and background,who will contribute diverse viewpoints and other attributes, with the goalperspectives in providing independent oversight of putting forth a diverse slate of candidates withmanagement. The Board believes that a combination of individuals who possess complementary attributes and skills will most effectively oversee the Firm’s strategy and business.

Personal and professional attributes and skills of the nominees

In furtherance of the foregoing, the Board considers a wide range of attributes when selecting and recruiting candidates. Our nominees have executive experience and personal qualitiesskills that will serve the Boardare aligned with our business and its committees, the Firmstrategy as follows: |

| | | | | | | | | | | |

FINANCIAL AND ACCOUNTING – Knowledge of accounting and financial reporting and of auditing processes and standards | | | | | | | | | | | |

| | | | | | | 12 | | | |

| | | | | | | | | | | |

FINANCIAL SERVICES – Experience in or with the financial services industry, including investment banking, global financial markets and consumer products and services

| | | | | | | | | | | All our nominees possess: • Collaborative approach to engagement and oversight• Inquisitive and objective perspective• Willingness to appropriately challenge management |

| | | | | | 10 | | | |

| | | | | | | | | | |

INTERNATIONAL BUSINESS OPERATIONS – Operational experience in diverse geographic, political and regulatory environments

| | | | | | | | | | |

| | | | 8 | | | | | |

| | | | | | | | | | |

LEADERSHIP OF A LARGE, COMPLEX ORGANIZATION – Senior executive experience managing business operations, development and strategic planning

| | | | | | | | | | |

| | | | | 9 | | | | |

| | | | | | | | | | |

MANAGEMENT DEVELOPMENT AND SUCCESSION PLANNING – Experience in senior executive development, succession planning, and compensation matters

| | | | | | | | | | |

| | | | | | 10 | | | |

| | | | | | | | | | |

PUBLIC COMPANY GOVERNANCE – Knowledge of public company governance issues and policies and governance best practices | | | | | | | | | | |

| | | | | | | 12 | | |

| | | | | | | | | | |

TECHNOLOGY – Experience with or oversight of innovative technology, cybersecurity, information systems/data management, fintech or privacy

| | | | | | | | | | |

| | | | | 9 | | | | |

| | | | | | | | | | |

REGULATED INDUSTRIES AND REGULATORY ISSUES – Experience with regulated businesses, regulatory requirements, and relationships with regulators

| | | | | | | | | | |

| | | | | | | 12 | | |

| | | | | | | | | | | |

RISK MANAGEMENT AND CONTROLS – Experience in assessment and management of business and financial risk factors | | | | | | | | | | | |

| | | | | | | 12 | | | |

| | | | | | | | | | | |

For additional information about our shareholders well.

director criteria, see our Corporate Governance Principles at jpmorganchase.com/corp-gov-principles.

Since our last annual shareholders meeting, the Governance Committee, using the process described above and taking into account, among other factors, shareholders’ interest in board refreshment and specifically adding directors with experience in risk management and financial services, recommended Todd A. Combs for election. Mr. Combs was introduced to Mr. Dimon in 2014 through discussions with Warren Buffett, Chairman of the Board and Chief Executive Officer of Berkshire Hathaway Inc., where Mr. Combs is an investment officer. Based on the introduction and Mr. Combs’ experience and reputation, Mr. Dimon suggested that the Governance Committee consider Mr. Combs as a prospective candidate. After meeting with Mr. Combs and reviewing his qualifications, which include experience in financial markets, risk assessment, and regulatory issues, his constructive personal attributes and his independence, the Governance Committee recommended his election by the Board in September 2016. For information on Mr. Combs’ qualifications, see page 14 of this proxy statement.

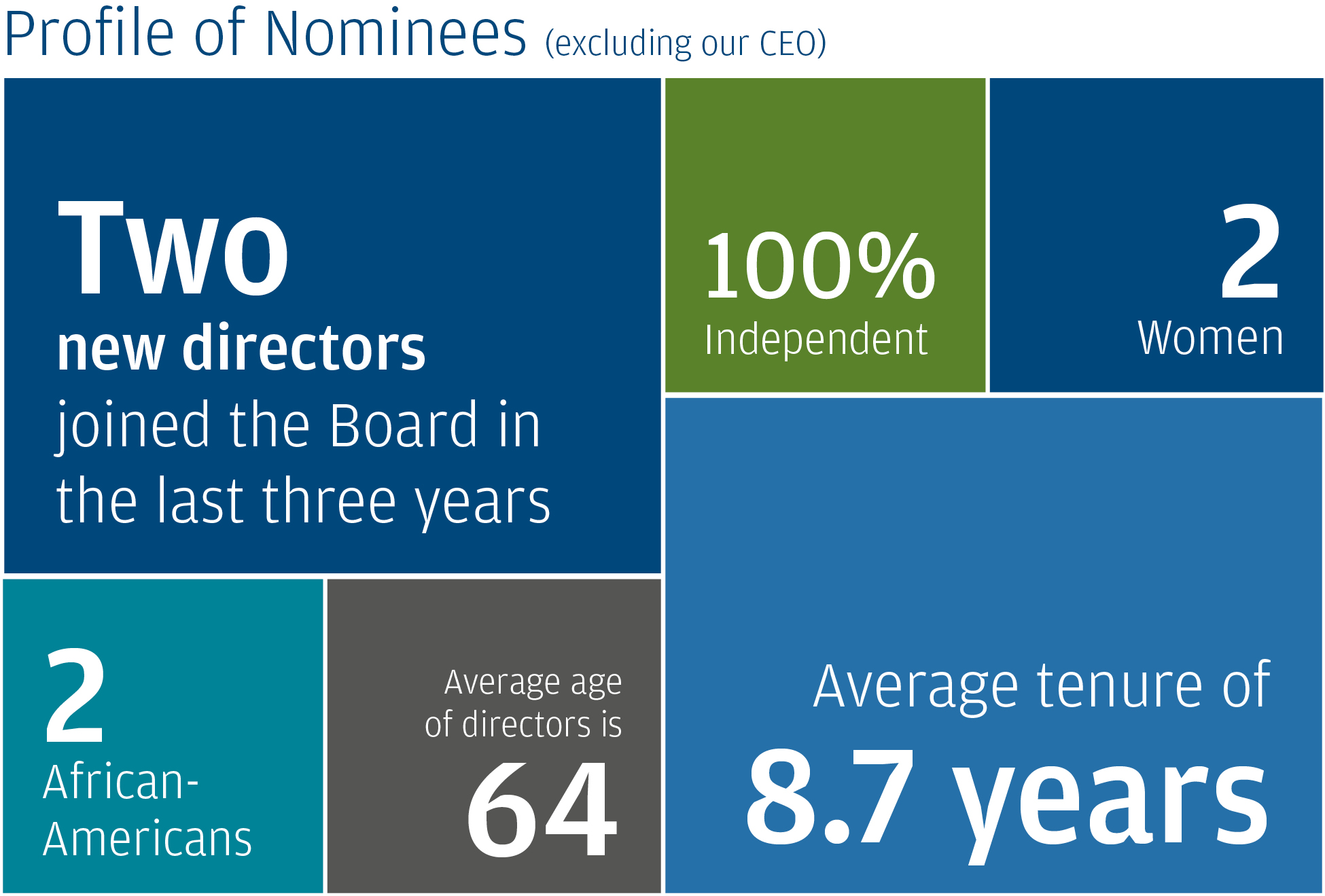

Board refreshment and succession

Director succession and an appropriate balance of refreshment and experience is a focus of the Governance Committee and the Board. The Governance Committee engages in ongoing consideration of potential Board candidates. Of the Board’s 11 independent directors, five have joined the Board since May 2011. The average tenure of our independent directors is 8.7 years as of year-end 2016. Mr. Combs’ election reflects the Board’s commitment to refreshment and its ongoing efforts to build and consider a pipeline of qualified candidates. New directors are subject to an onboarding process which includes, among other items, new director orientation and education, Code of Conduct training, and one-on-one meetings with Board members, management, and certain of our regulators. Educational opportunities are provided to all directors on a continuing basis.

The Board also considered succession and refreshment in its review of Board committee membership. In March 2017, Ms. Bammann became Chair of the Directors’ Risk Policy Committee and stepped down from the Public Responsibility Committee; Mr. Bell became Chair of the Audit Committee; Mr. Combs joined the Directors’

|

| | |

| 17 | | 8 •JPMORGAN CHASE & CO. • 20172018 PROXY STATEMENT

|

Independence

Risk Policy CommitteeAll of the Firm’s non-management Board members are independent, under both the NYSE corporate governance listing standards and the Public Responsibility Committee;Firm’s independence standards as set forth in its Corporate Governance Principles.

For a director to be considered independent, he or she must have no disqualifying relationships as defined by the NYSE, and the Board must have affirmatively determined that he or she has no material relationships with JPMorgan Chase, either directly or as a partner, shareholder or officer of another organization that has a relationship with the Firm.

In assessing the materiality of relationships with the Firm, the Board considers relevant facts and circumstances. Given the nature and broad scope of the products and services provided by the Firm, there are from time to time ordinary course of business transactions between the Firm and a director, his or her immediate family members, or principal business affiliations. These may include, among other relationships: extensions of credit; provision of other financial and financial advisory products and services; business transactions for property or services; and charitable contributions made by the JPMorgan Chase Foundation or the Firm to a nonprofit organization of which a director is an officer. The Board reviews these relationships to assess their materiality and determine if any such relationship would impair the independence and judgment of the relevant director.

The relationships and transactions the Board considered in evaluating each director’s independence were as follows:

| |

| ▪ | Consumer credit: extensions of credit provided to directors Bowles, Hobson and Jackson; and credit cards issued to directors Bammann, Bell, Bowles, Crown, Flynn, Jackson, Neal, Raymond, and Weldon, and their immediate family members |

| |

| ▪ | Wholesale credit: extensions of credit and other financial and financial advisory products and services provided to: NBCUniversal, LLC and Comcast Corporation, for which Mr. Burke is the Chief Executive Officer and a senior executive, respectively, and their subsidiaries; Berkshire Hathaway Inc., for which Mr. Combs is an Investment Officer, and its |